Pillars’ Strategy:

Since 2020, we’ve navigated:

- Pandemics • Policy Shifts • Wars • Banking Crises • Elections • Trade Wars

The Result…

The market corrected, consolidated, and hit New All-Time Highs.

The Market Crisis are the Greatest Wealth Generators.

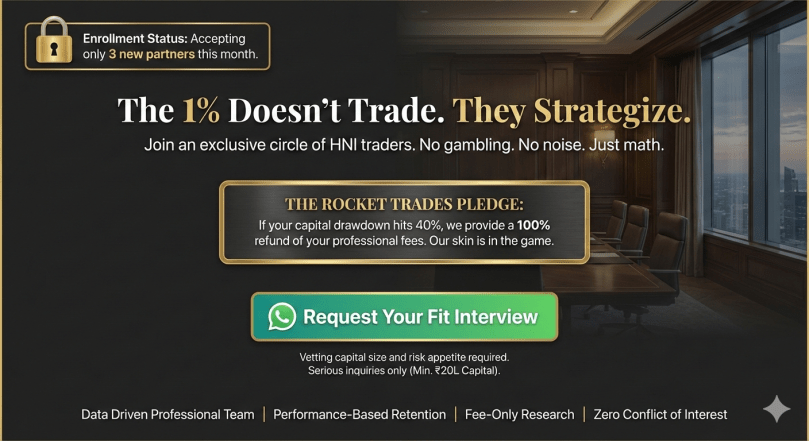

Why RocketTrades…

- Stop Fearing the Correction. Start Profiting From It.

- Our Pillars’ Strategy is designed to find the signal in the noise.

- We protect your core capital with a 40% risk-management threshold.

- Professional Grade Research for HNI traders. Pure Discipline for Just Results.

- We remove guesswork and trading stress by focusing on the edge that matters.

👇

Your 10 lac shall be 1 Crore in 5 To 7 Years.

Reward – Risk – Expenses

How can you generate 10 Times Return in 5 To 7 Years, Are You Serious ? 🤔

- Rest assured, we are very much Serious.

- Our Pillars’ Strategy could compound your Invested Core Capital of 10lac by 100% every 18 Months.

- Provided, you don’t ever ignore any of our Trading Call and Market Instruction for any reason and never withdrew any funds.

Are you claiming that Pillars’ Strategy is 100% accurate ? 💭

- No. Pillars’ Strategy is not 100% Accurate. what we are claiming is if you follow Stop-loss, stick with Instructions then relatively you are much safer in any given Market conditions.

- You must read our following attached post, there we did show 10lac plus loss booked by following Stop-loss in the 25 Month’s period (From July 2019 To July 2021).

- Check out: “Only ₹10,09,281.53/- Loss Booked by following SL”

- All this is backed by Zerodha Back Office Records of the Member at 100% Club of Rocket Trades.

- Actual Performance of 8+ Quarter is much long term period in Trading. During this Period, NIFTY50 had moved 16266pts Up Down in total.

You talked about Return, and then Risk. What about Expenses…💰

You have 4 Major Heads’ of Expenses,

- Market Losses: Hitting Stop-losses, Missing Trading Calls. We compensate this head 100% at no extra cost.

- Trading Related Charges: Brokerages, STT, Stamp Duty, etc

- GST & Short Term Capital Gain Taxes

- Rocket Trades’ Consultation Fee.

Intra-day Stock Trading is considered as Speculative.

And, F&O Trading is considered as Non-Speculative. And, that is what we do.

The Market Crisis are the Greatest Wealth Generators.

👆 Turn Chaos Into Opportunity.

Pillars’ Strategy is focused and specialized for NIFTY & Stock Futures. Optimized for the Market Volatility thus giving only 25++ Calls per Year. Base of our Strategy are various permutation and combinations of Fundamental, Technical, Sentimental and Astrology Indicators and values.

Strictly adhering SEBI Rules & Regulation.

100% Fee Refund Guarantee if Capital drawdown hits 40%

Genuinely, Cares for You ‼