Pillars’ Strategy:

Since 2020, we’ve navigated:

- Pandemics • Policy Shifts • Wars • Banking Crises • Elections • Trade Wars

The Result…

The market corrected, consolidated, and hit New All-Time Highs.

Hence, the Market Crisis are the Greatest Wealth Generators.

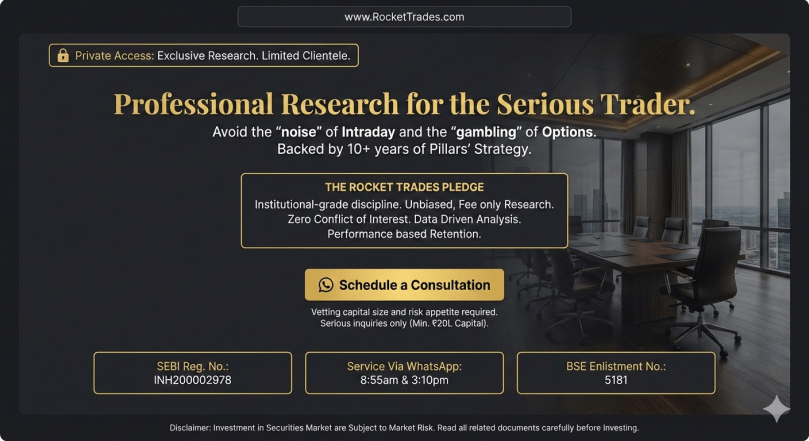

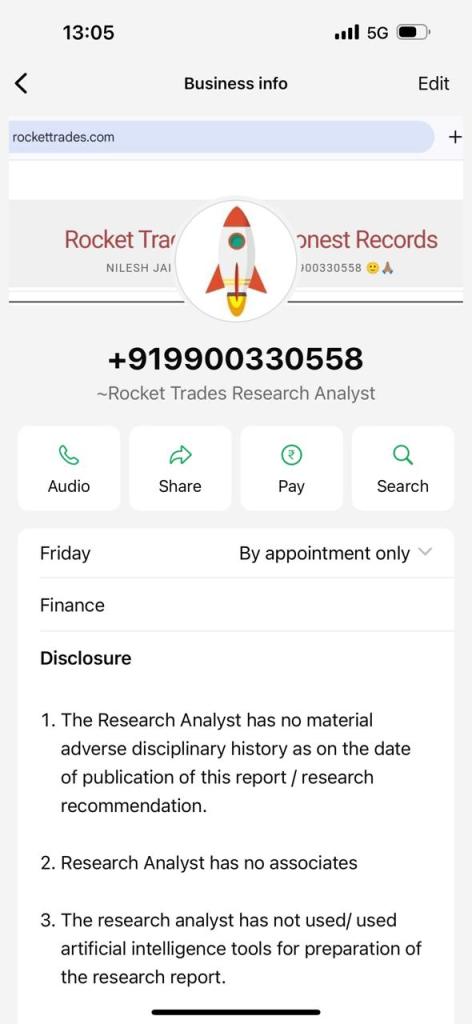

Why RocketTrades…

- Precision: 20–25+ high-probability calls/year (quality > quantity).

- Risk Management: 40% threshold, pre-defined entries/exits, dynamic stop-losses.

- Transparency: 100% live updates on WhatsApp (wins & losses, timestamped).

- Discipline: “One Script One Lot” rule + market-hours support.

- We remove guesswork and trading stress by focusing on the “EDGE” that matters.

👇

Suitability Check

Please finish this mandatory self-assessment. We value quality over quantity.

We are “NOT” for you if your capital is under 20L. 🤔

- Which best describes the capital you are using to trade? (A) Discretionary income/Savings dedicated to investment. (B) Essential funds (Rent, bills, or emergency savings).

- Requirement: Must be (A). If (B), please exit. We do not support high-stakes survival trading.

We are “NOT” for you if you want daily excitement. 💭

- How do you respond to a 3-trade losing streak? (A) Review the Market Events which made this losses, check my available Capital, and wait for the next setup. (B) Increase my position size to win it all back immediately.

- Requirement: Must be (A). If (B), please exit. Revenge trading is the fastest way to blow an account.

We are “NOT” for you if you can not handle Black Swan Event. 💰

- What is your primary goal for joining Rocket Trades? (A) To follow a repeatable system and achieve long-term compounding. (B) To find a “hot tip” that will double my account by end of next month.

- Requirement: Must be (A). If (B), please exit. We are a school of strategy, not a lottery terminal.

Intra-day Stock Trading is considered as Speculative.

And, Trading in Futures is considered as Non-Speculative. And, that is what we do.

The Market Crisis are the Greatest Wealth Generators.

👆 Turn Chaos Into Opportunity.

Pillars’ Strategy is focused, specialized for NIFTY & Stock Futures. Optimized for the Market Volatility thus giving only 25++ Calls per Year. The strategy is built on a multidimensional framework, combining Fundamental (60%), Technical (30%), Sentimental (7%), and Astrology (3%) indicators for robust analysis.

Genuinely, Cares for You ‼

The Trend Is Clear:

Corrections are temporary. Growth is permanent.

At RocketTrades, we don’t fear the dip. We prepare for it.