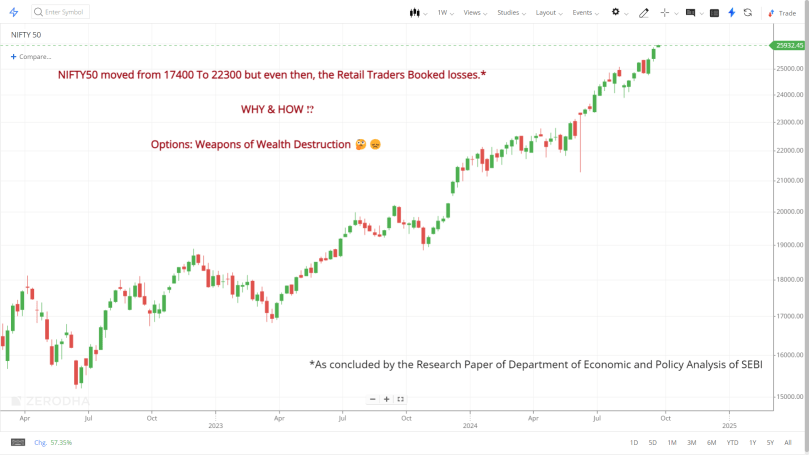

- 91.1% of individual traders (about 73 lakh traders) lost money in the F&O segment in FY24.

- In FY24 alone, Individuals incurred about ₹75000 crore in net losses.

- Only 7.2% of Individual F&O traders made a profit over the period of three years.

- Only 1% of individual traders managed to earn profits exceeding ₹1 lakh, after adjusting for transaction costs in F&O over the period of three years.

- Individuals incurred more than ₹50,000 crores in transaction costs for trading in F&O during FY22 to FY24. Of which more than half (about ₹25,000 crore) was in the form of brokerage, followed by ₹13,800 crores to the Government in the form of STT, GST and Stamp duty and ₹10,200 crore in the form of Exchange fees.

- Higher trading activity was associated with a higher percentage of loss-makers.

- Compared to ‘Male’ traders, less proportion of ‘Female’ traders incurred losses.

- More than 50% of all the F&O traders, who traded in FY24, were from top four states namely Maharashtra, Gujarat, Uttar Pradesh and Rajasthan.

- More than 75% of the loss-makers persisted with the trading in F&O, despite making losses in preceding two consecutive years. However, only 8.3% of traders, who persisted to trade in F&O in third year in spite of losses in two preceding years, succeeded to make profit in third year.

- India’s derivatives market has witnessed remarkable growth since its inception in June 2000, when the National Stock Exchange (NSE) launched trading in Index Futures.

- The number of Retail traders, or Individual traders (Individuals) have almost doubled in two years from about 51 lakhs in FY22 to about 96 lakhs in FY24.

- Further, compared to Mutual Fund investors, the number of Individual F&O traders have grown faster.

- Therefore, this rapid growth in F&O trading activity has once again highlighted the need for investor education and risk management practices, as a significant proportion of retail traders continued to incur losses in the market.

- Definitions of categories for Section 1 Data

- Proprietary Traders —— Trading Member, who itself trade in F&O in its own account. (Total 626 Traders only)

- Individuals —— Individuals, HUF, Proprietorship Firm, Partnership Firm, Limited Liability Partnership Firm (Total 95,75,473 Traders only)

- It may be noted that the sample of earlier SEBI study was based on Top 10 brokers, whereas that of current study is based on the sample collected from Top 15 brokers.

- These top 15 brokers account for nearly 90 percent of total individuals

- Tier I (The following 7 cities considered – Banglore, Delhi, Chennai, Hyderabad, Mumbai, Pune, Kolkata).

- Tier II (The following 20 cities considered – Amritsar, Bhopal, Bhubaneswar, Chandigarh, Faridabad, Ghaziabad, Jamshedpur, Jaipur, Kochi, Lucknow, Nagpur, Patna, Raipur, Surat, Visakhapatnam, Agra, Ajmer, Kanpur, Mysuru, Srinagar),

- Tier III (The following 19 cities considered – Etawah, Roorkee, Rajamundry, Bhatinda, Hajipur, Rohtak, Hosur, Gandhinagar, Junagadh, Udaipur, Salem, Jhansi, Madurai, Meerut, Mathura, Bikaner, Cuttack, Vijayawada, Nashik).

- For computation of profit/loss- realized profit/loss during the period is considered.

- In FY24, the Proprietary traders’ category earned the highest gross profit (i.e. trading profits before accounting for transaction costs) of about ₹33,000 crore in the equity F&O segment of NSE.

- While, Individuals made losses in Options to the tune of ~ ₹55,000 crore in FY24, they made profits to the tune of about ~ ₹13,400 crore in Futures.

- “Others” category, which includes mainly Corporates, NRIs and Trusts, made losses with Algos, but profit without Algos

- It was observed that the percentage of Individual traders making losses in Futures contracts is constantly lower than those making losses in Options contracts throughout the study period.

- Individual’s losses in Options segment grew 30.8% year-on-year to ₹77,800 crore in FY24, while they made gains of ₹3,000 crore in Futures (compared to losses of about ₹6,200 crore in FY23).

- In Futures, individuals made an average net profit of about ₹60,000 per person in FY24, compared to loss of ₹1,28,000 per person in FY23.

- On an average, Individuals spent ~ ₹ 26,000 per person as a transaction cost in FY24.

- During FY22 to FY24, there were a total of 1.13 crore unique Individual traders, who traded in F&O at least once during these three years. And, 0.70 lakh traders (or 0.6% traders) traded only Futures.

- It was observed that higher trading activity was associated with a higher percentage of loss-makers.

- As traders age increased, the percentage of loss-makers in F&O declined, indicating relative risk aversion, better risk management or the experience coming into play for elderly traders compared to young traders.

- Low Income: declared annual income less than ₹5 lakh

- Mid Income: declared annual income between ₹5 lakh to ₹25 lakh

- High Income: declared annual income less than ₹25 Lakh to ₹ 1 Crore

- The percentage of loss-makers for “Low Income” traders’ category was the highest (92.2% in FY24)

- As traders’ annual income increased, the percentage of loss-makers in that category had declined.

- Compared to ‘Male’ traders, the proportion of ‘Female’ loss-making traders in F&O was lower across the years.

- In terms of state-wise pattern of average per person loss, it was observed that all the top four states with highest average per person loss were from southern region of India, namely Telangana (1.97 lakh per person loss), followed by Andhra Pradesh (1.45 lakh per person), Tamil Nadu (1.37 lakh per person) and Karnataka (1.35 lakh per person).

Analysis of Profits & Losses in the Equity Derivatives Segment (FY22 – FY24)

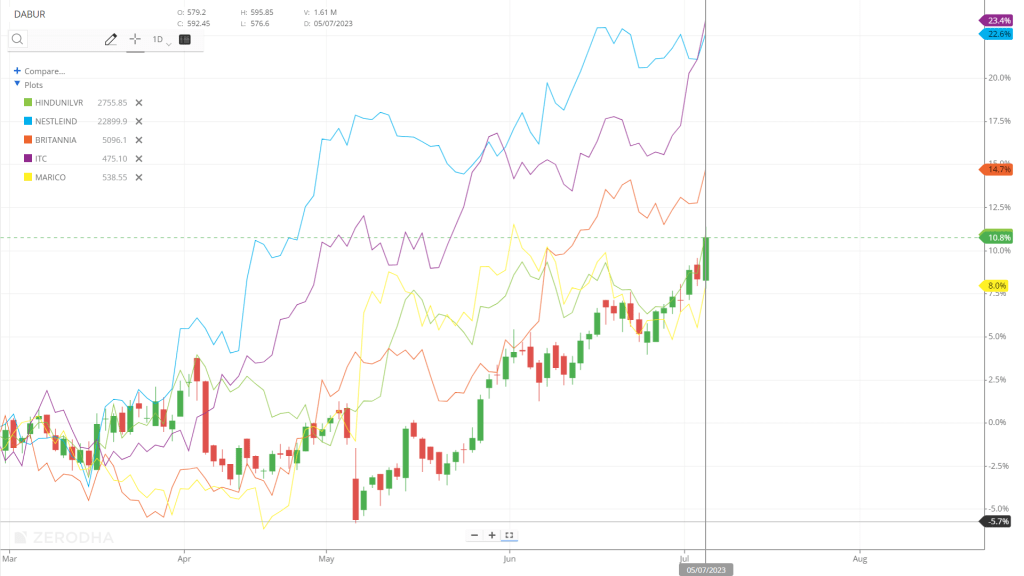

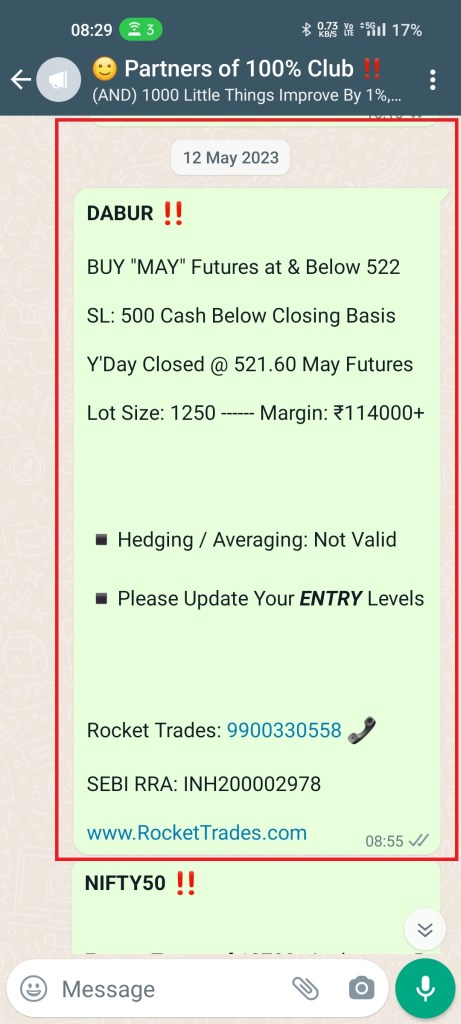

Rocket Trades

We are Strictly fee only Research House armed with proprietary methods & workings.

Call, Text, WhatsApp: +91 99003 30558

Trading Counsel, Support & Guide

SEBI RA: INH200002978, Bengaluru

E-Mail ID: Rocket@RocketTrades.com

You must be logged in to post a comment.