NIFTY50: “3000pts in 26 Days” – Magic to Logic… 😮

Fact or Trivia:

We all believe in magic because: We can’t accept the truth. And the truth in investing or Trading are universal, which are,

Permutations and combinations,

- BUY Low, Sell High to be profitable

- BUY High, Sell even Higher to be profitable

- Sell Low, BUY even Lower to be profitable

Question is how many people do this successfully every now and then,

Answer: Not many. Just Few.

Media Analyst vs Financial Analyst

Experienced Financial Analysts would suggest you to BUY the Market at 23000 or 22000 levels of NIFTY50.

But the Irony is that People would not trust them.

Because their advice contradicts the so-called smart experts who shouts on Social Media.

They are not authorized to suggest in the first place. Secondly, if they are proven wrong they would not give you follow-ups and / or share their back-up plans.

All the messages on Social Media are always one way Street. Yet, you can demand answers from SEBI Registered Financial Analysts anytime you want. Not once but as many times as you want.

So, our take is that people should not trust them with their Capital. These include social media influencers and Business Channel anchors. But So far, they are enjoying unlimited reach and unmatched visibility.

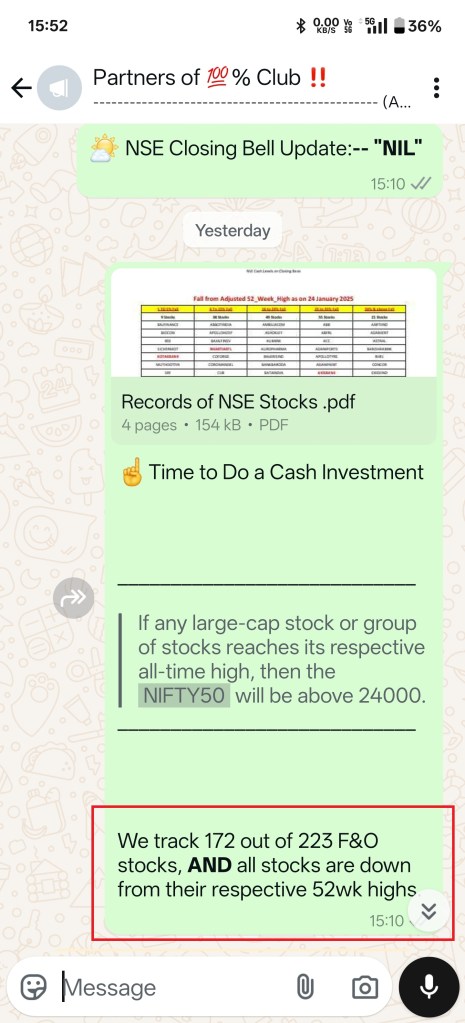

Time for fact check:

The S&P 500 briefly fell into a correction territory in the 3rd Week of March 2025, meaning the U.S. stock index was down 10% from its recent peak.

There have been 27 such market corrections since November 1974. This includes the March 2025 move. That amounts to roughly one every two years or so, on average.

Just six of those corrections became “bear markets” (in 1980, 1987, 2000, 2007, 2020 and 2022). A bear market is a downturn of 20% or more.

The “TREND”… comes from the Long Term History. 🤭🫢

Now, please ask yourself in this context and background should not you be buyer in Market at every 10% Fall… 🤭🤔

In our honest opinion, you should buy.

We were the net buyer every time.

We are now the net buyer. We will be the net buyer in the future.

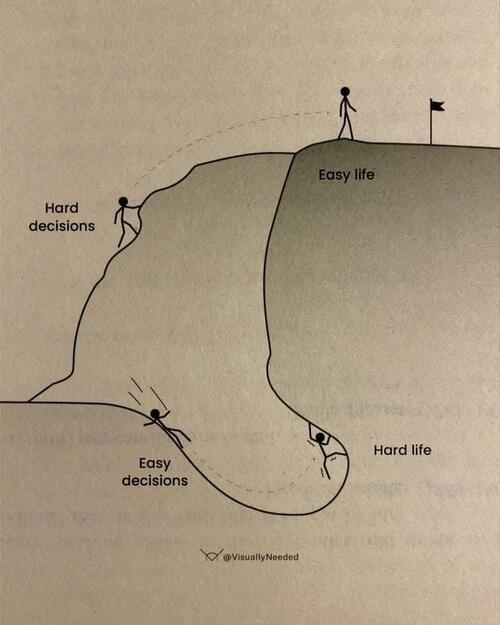

The truth is you, as a Trader or Investor, can’t control emotions like Greed and Fear. You can achieve this only through Logic and Discipline.

You need to be above confirmation bias, stop seeking the sources that tell you are “right.” And this will happen when you show courage to move in opposite direction of the “crowd.”

- Perpetual Bears will talk only about “horror and destruction.”

- Perpetual Bulls will keep talking about “hang on, keep putting money in. You’re a long-term investor, right?”

You will be better off. Surround yourself with those who understand “risk and reward.” They should also understand the “math of loss.”

Successful Traders buy cheap and sell expensive because they deeply understand the relationship between risk and reward.

They are the “non-stupid.”

These are the ones you should follow.

Not the ones screaming at you on Social Media (Television). They tell you to “buy, buy, buy” or to “sell, sell, sell” at every market turn and twist.

Remember that for every full-market cycle, our job is to join in the first half. Prices typically rise during this period. We must avoid the devastation during the second half.

Believe us, One Correction is enough to change your Financial life. 🙂🙏🏽

Rocket Trades

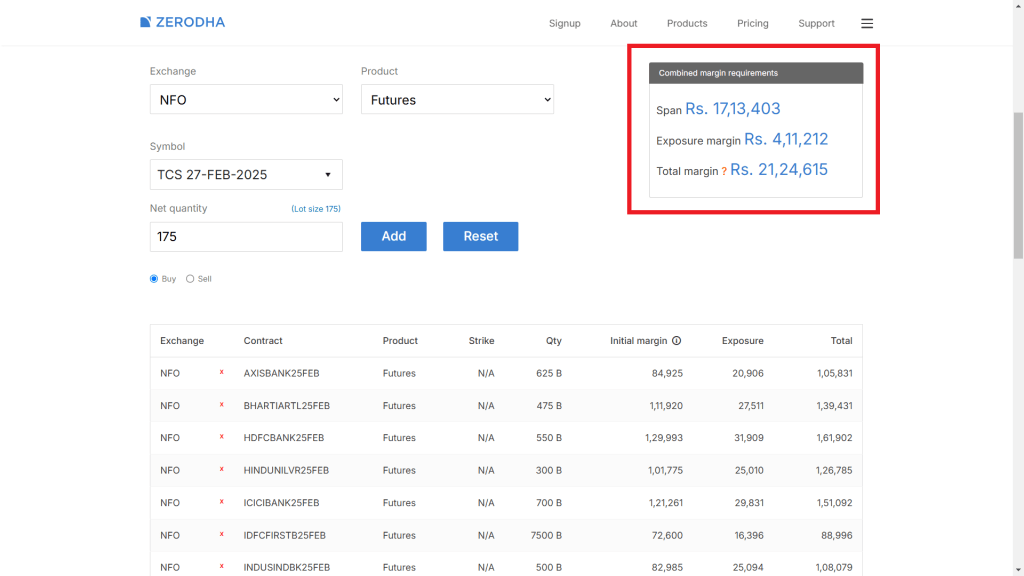

We are Strictly fee only Research House armed with proprietary methods & workings.

Call, Text, WhatsApp: +91 99003 30558

Trading Counsel, Support & Guide

SEBI RA: INH200002978, Bengaluru

E-Mail ID: Rocket@RocketTrades.com

You must be logged in to post a comment.