Unbelievable ‼️

We are improvising our trading strategy and working methodology every single day to achieve the target of ₹100 Crores from ₹20lac Capital in the next 21 To 24 Years…

Because, we are only “22” years away from our 100th Independence Day.

The NIFTY50 traveled from 5200 to 25200 levels from September 2013 To September 2024, period of 11 years. Therefore, by that logic, this is very much possible to see NIFTY50 from present 26000 levels to 51000++ levels by 2035…

But, rest assured there will be bear Markets in between. DO NOT MISS THE “BOTTOM“ 🙂🙏🏽

How we will be doing this

Best Strategy to do so is be a Buyer at each & every crisis, no over trading or options or Intraday, trading without Stop-loss should be avoided at all cost, withdrawal of funds for any reason or purpose is not recommended, don’t follow particular prevailing market theme or fashion, don’t short sell anything which has limited supply or going to be in a short supply rather be a buyer for that even at an all-time high.

And, most importantly, this (₹100 Crore Target) will be never possible without leverage, patience and discipline. Though not compulsory but time to time addition of capital is always helpful, even for temporary or short-term basis.

The core of everything we do at Rocket Trades is transparency. And, because of this reason we are updating every profit and loss to our clients on our website from day one with WhatsApp Screenshot.

This is where things become interesting…

When it comes to producing real prosperity, manipulating money is never the answer.

Top 15 Profits

Top 15 Losses

| SL | Stock’s Name | Profits |

| 1 | TATAMOTORS | +290000 |

| 2 | JUBLFOOD | +99000 |

| 3 | SUNTV | +96000 |

| SL | Stock’s Name | Losses |

| a | HAVELLS | -130000 |

| b | BHARATFORG | -50000 |

| c | IGL | -20625 |

| SL | Stock’s Name | Profits |

| 1 | TATAPOWER | +384000 |

| 2 | BAJAJ-AUTO | +132000 |

| 3 | SBIN | +93000 |

| SL | Stock’s Name | Losses |

| a | ICICIGI | -125000 |

| b | NTPC | -74000 |

| c | TATAMOTORS | -68000 |

| SL | Stock’s Name | Profits |

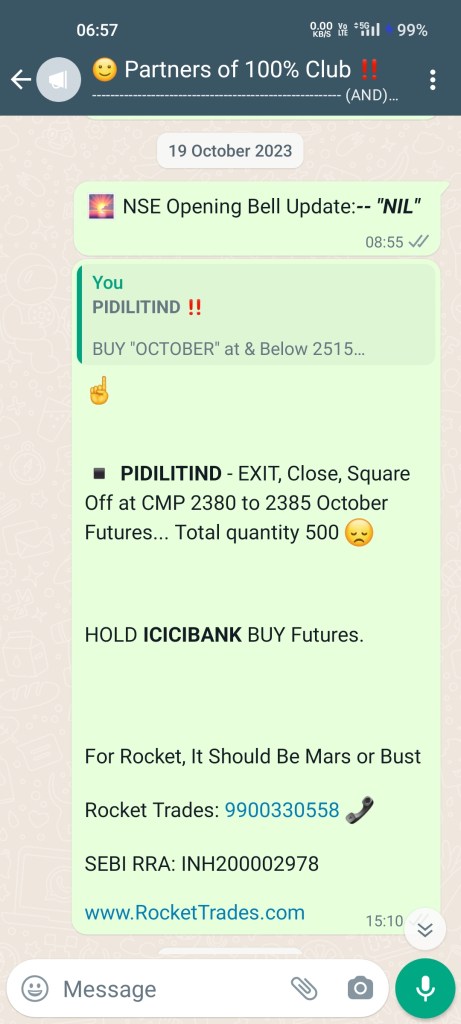

| 1 | TATAMOTORS | +50000 |

| 2 | HINDPETRO | +33000 |

| 3 | PIDILITIND | +7000 |

| SL | Stock’s Name | Losses |

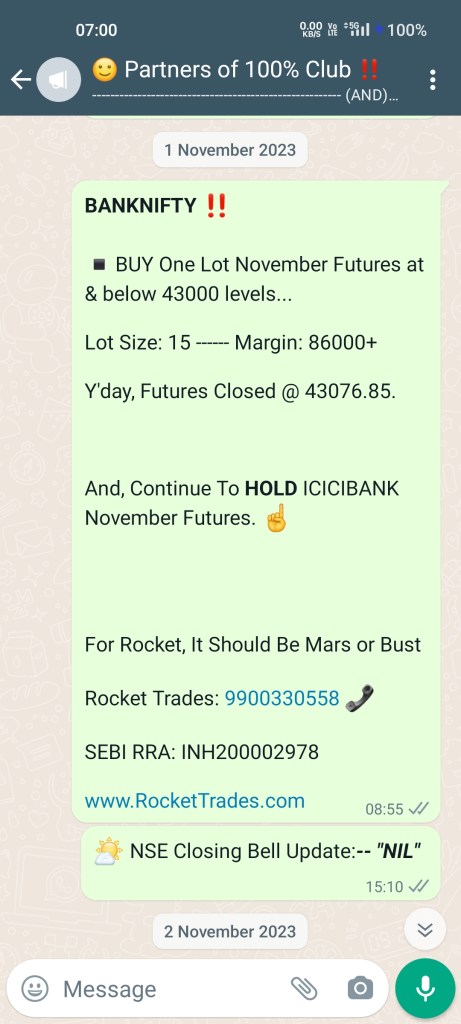

| a | BANKNIFTY | -120000 |

| b | TORNTPHARM | -115000 |

| c | NIFTY | -75000 |

| SL | Stock’s Name | Profits |

| 1 | DABUR | +167000 |

| 2 | BANKNIFTY | +123000 |

| 3 | NIFTY | +120000 |

| SL | Stock’s Name | Losses |

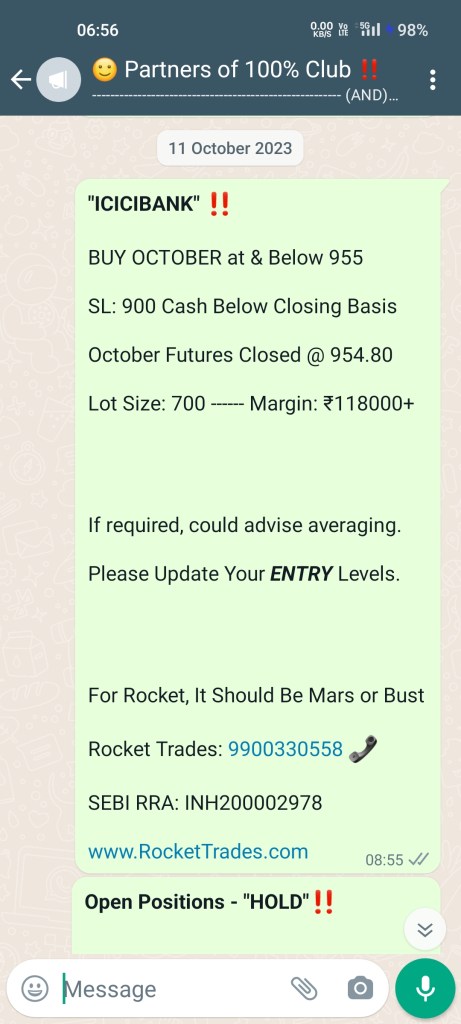

| a | PIDILITIND | -68000 |

| b | GODREJPROP | -50000 |

| c | FEDERALBNK | -40000 |

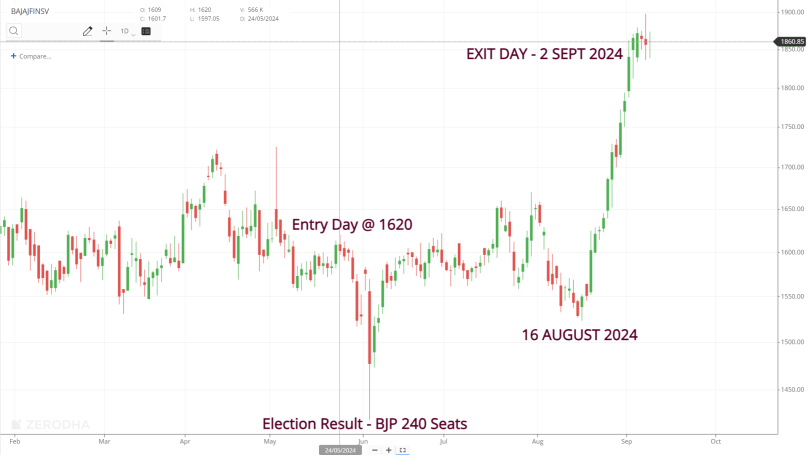

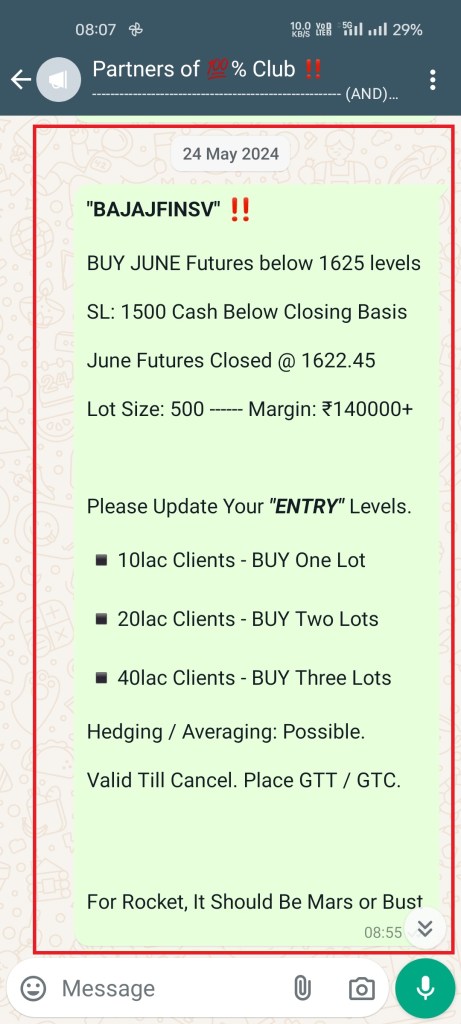

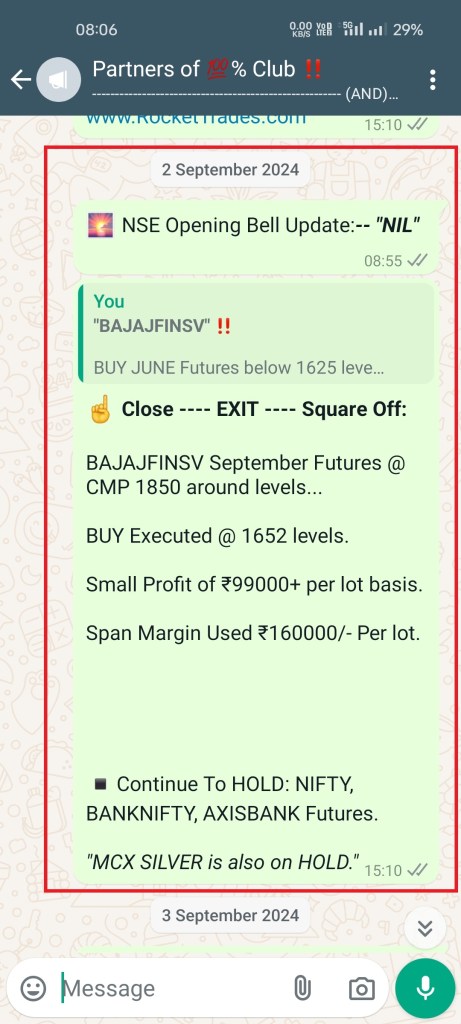

| SL | Stock’s Name | Profits |

| 1 | BAJAJFINSV | +99000 |

| 2 | BANKNIFTY | +96750 |

| 3 | NIFTY | +62500 |

| SL | Stock’s Name | Losses |

| a | NIFTY BANKNIFTY COMBO | -7200 |

| b | TCS | -5000 |

| c | NIFTYNXT50 | -2000 |

Only 1% of individual traders managed to earn profits exceeding ₹1 lakh, after adjusting for transaction costs in F&O over the period of three years.

Performance Summary till date only on “5lac” Capital

| Calendar Year | No. of Calls | Total Losses | Total Profits | NET Result | ROI3 |

|---|---|---|---|---|---|

| 2020 (Apr Dec) | 23 | -217625 | 798000 | 580375 | 116.075 |

| 2021 (Jan Dec) | 25 | -582600 | 1003500 | 420900 | 84.18 |

| 2022 (Jan Dec) | 12 | -417000 | 90000 | -327000 | -65.4 |

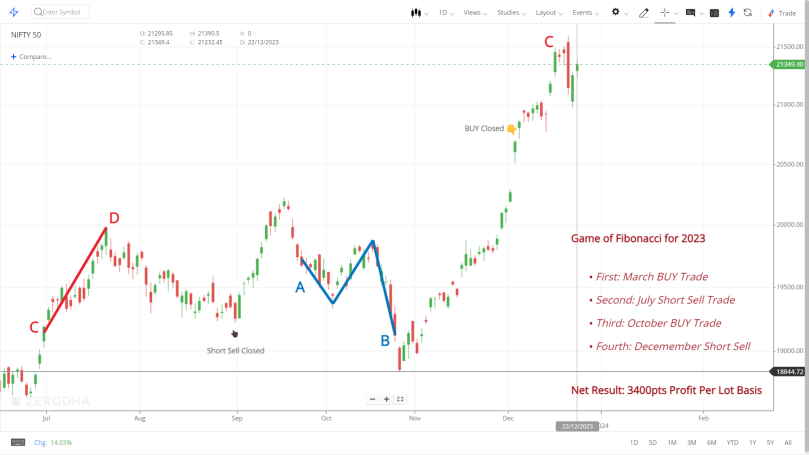

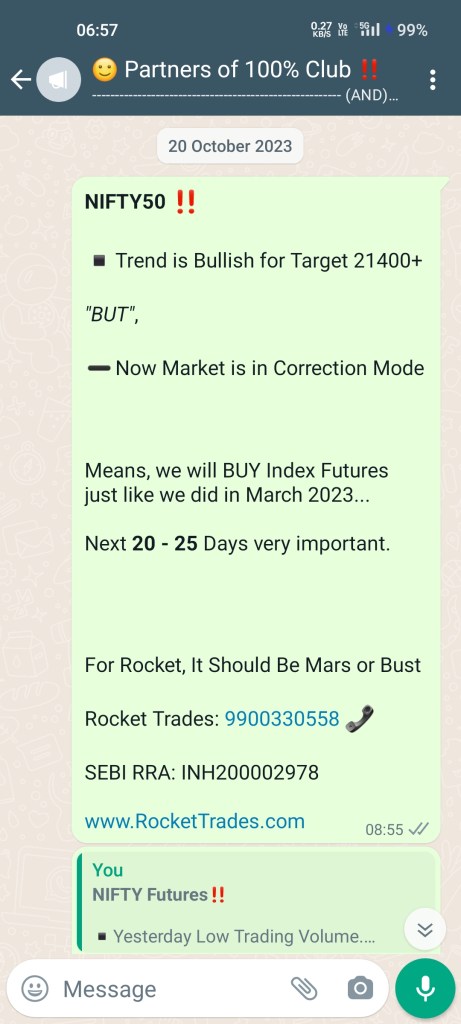

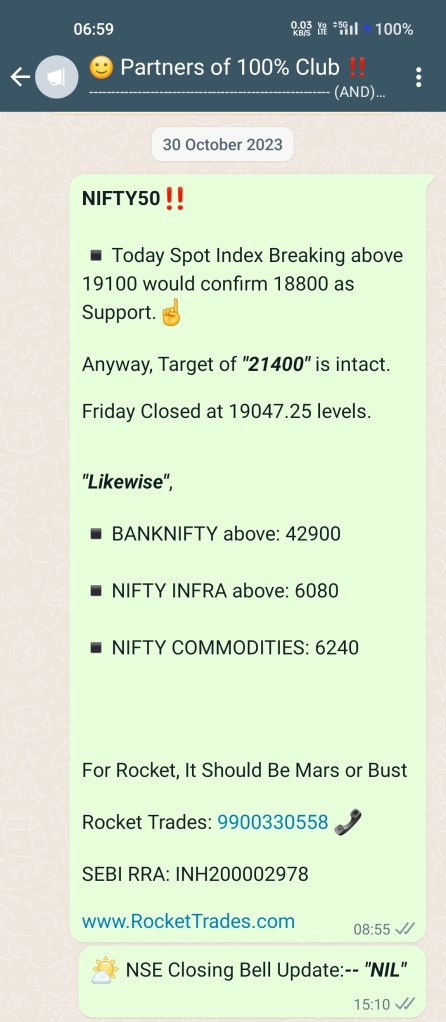

| 2023 (Jan Dec) | 20 | -247700 | 722900 | 475200 | 95.04 |

| 2024 (Jan Sep) | 11 | -14200 | 338050 | 323850 | 64.77 |

| Grand Total | Total 91 Calls | -1479125 | 2952450 | ₹14,73,325/- | 294.665 |

Remarks:

- Past Performance is no guarantee for future performance.

- Please understand that 30% risk will always be there on Capital or Fund or Account Size.

- Generating Profit is a sole purpose of our existence. But, In any sense, we are not offering any kind of profit guarantee.

- As of now, we are only a independent Research House registered with the SEBI. But, in future our organization’s structural status can change. For Example: Our next stage of growth to become a Portfolio Management Company, however Ownership will not change, nor the Management.

- As of now, we have in house developed four Trading strategies. And, they are: Pillars’ Strategy, Game of Fibonacci, VIXNOMICS, and Major Minor Strategy. Improvisation to better alignment with the Market of above-mentioned strategies are ongoing and we promised to ourselves that will never be stopped.

- As of now, we are tracking only top 160 derivatives Stocks of NSE, and NIFTY, BANKNIFTY, and MCX Silver, only.

- ₹100 Crores is a Gross amount,excluding of all Government related Taxes, Broker & Trading Related Expenses and Research & advisory related Expenses.

- Next review will be updated in the first week of April 2029 —— that is exactly after 9 years from the NIFTY50 bottom driven by COVID-19 crisis to ascertain our consistency and transparency.

- Trading is a risk preposition therefore not recommended for everyone. Only those should do trading who can comfortably bear Market Risk, pressure and tension of capital loss, and that to without compromising their personal life and health.

- We will be moving in sync of Fibonacci Sequence, that is: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181… To achieve our intended Target of ₹100 Crore. We are assuming to achieve to next sequence number on an average in 18 months.

Do it yourself:

HOLD some cash and prepare yourself psychologically, so you have the gumption to deploy it when there’s blood in the streets.

Some of the past examples and recall what happened thereafter,

- Dot.com Bubble Burst in 2000

- Subprime Mortgage Bubble Burst in 2008

- COVID-19 driven Sell Off in 2020

The Market had many falls (price correction, profit bookings) in between as well. But each time mainly because of international news, events, happenings. Quick Fall Quicker Recovery.

That the future is uncertain. Therefore, one must always remain cautious and prepared for unexpected events.

Few Words for the beginners:

The problem is that Inexperienced analyst only focuses on recent price chart history – and not “in context” (as we love to say). Context is particularly important when it comes to analyzing Market Movements via technical analysis – as their narrative collapses when looking at a long enough timeline.

Rocket Trades

We are Strictly fee only Research House armed with proprietary methods & workings.

Call, Text, WhatsApp: +91 99003 30558

Trading Counsel, Support & Guide

SEBI RA: INH200002978, Bengaluru

E-Mail ID: Rocket@RocketTrades.com

- Please Check 10 February & 13 March 2023 WhatsApp messages. Profit achieved 1,30,000/- on 100 QYT of NIFTY Futures is not added in the performance of 2023. ↩︎

- Please check 31 January and 25 July 2024 messages about SILVER. The 1,74,000/- Booked Profit per lot basis of SILVER is not added here. ↩︎

- Return on Investments. ↩︎

- Subject to Market Conditions, Time is variable. Hopefully Clients willing to assume 30% Market Risk. ↩︎

- Compounding (1 To 2, 2 To 4, 4 To 6, 6 To 8) is Possible only if Funds are not withdrawn and increment risk is taken with time. ↩︎

You must be logged in to post a comment.