Greetings !

Nifty is nothing but average value of Top 50 (sometimes 55) Stocks’ Prices which (in turns) are driven by many permutations & combinations and It is near impossible to track all.

However, we can broadly divide all those permutations & combinations in two Fundamental Forces (matrix) which dictates Stock Market Price movements, namely

~ Macros – Overall Economy – as measured by FOREX & BONDS

~ Micros – Industry & Company Specific – Measured by Commodity Price Movements

Therefore, It is imperatives to understand their individual characters & impact on Stocks

~ FOREX: Country Specific Currency Appreciation helps in Exports, which increases trade surpluses in favour of Exporting Country which helps in overall Governmental Finances resulting in Increased Credit Ratings and Finally increased Investments by Private Investors.

That’s what USA is doing right now from TAX Reforms, Infrastructure Spending, High spending on Research & Development, etc. CHINA was doing it earlier and GERMANY is doing day in day out. Currently, INDIA is enjoying Rupee Appreciation.

~ BONDS: Defines Cost of Credits. Every Commerce Students had read this: Finance is bloodline of a Business. Therefore, easy & cheap Finance is always a welcome benefit of various QE’s (quantitative easing) programs of developed world’s Central Bankers.

At present, world over BONDS Prices are bullish which means Yields (cost of credits) are depressing enough to sustain high Stocks Prices especially in absence of rising Inflation.

Though, BONDS are long term instruments but their accounting impacts Quarterly Results.

~ COMMODITY (OIL, METALS, AGRI, & what not) : Present Low reading of Inflation vis-a-vis historical reference points means Commodity Prices are in Stable mode, therefore resulting in manufacturing cost in check, again Bullish sign for Stocks.

Possible Scenarios: Nifty Target during 2018

Bullish: Further Improving Macros & Micros from current readings will Hit NIFTY 12000

Semi-Bullish: Improving Macros but stable Micros will hit NIFTY 11000 & then expect Sideways and/or heighten volatile Price action

Semi-Bearish: Stable and/or even deteriorate Macros from current levels but Improving Micros will hit NIFTY 9700 & then expect Sideways and/or heighten volatile Price action

Bearish: Deterioration of both Macros & Micros from current levels will Hit NIFTY 8000

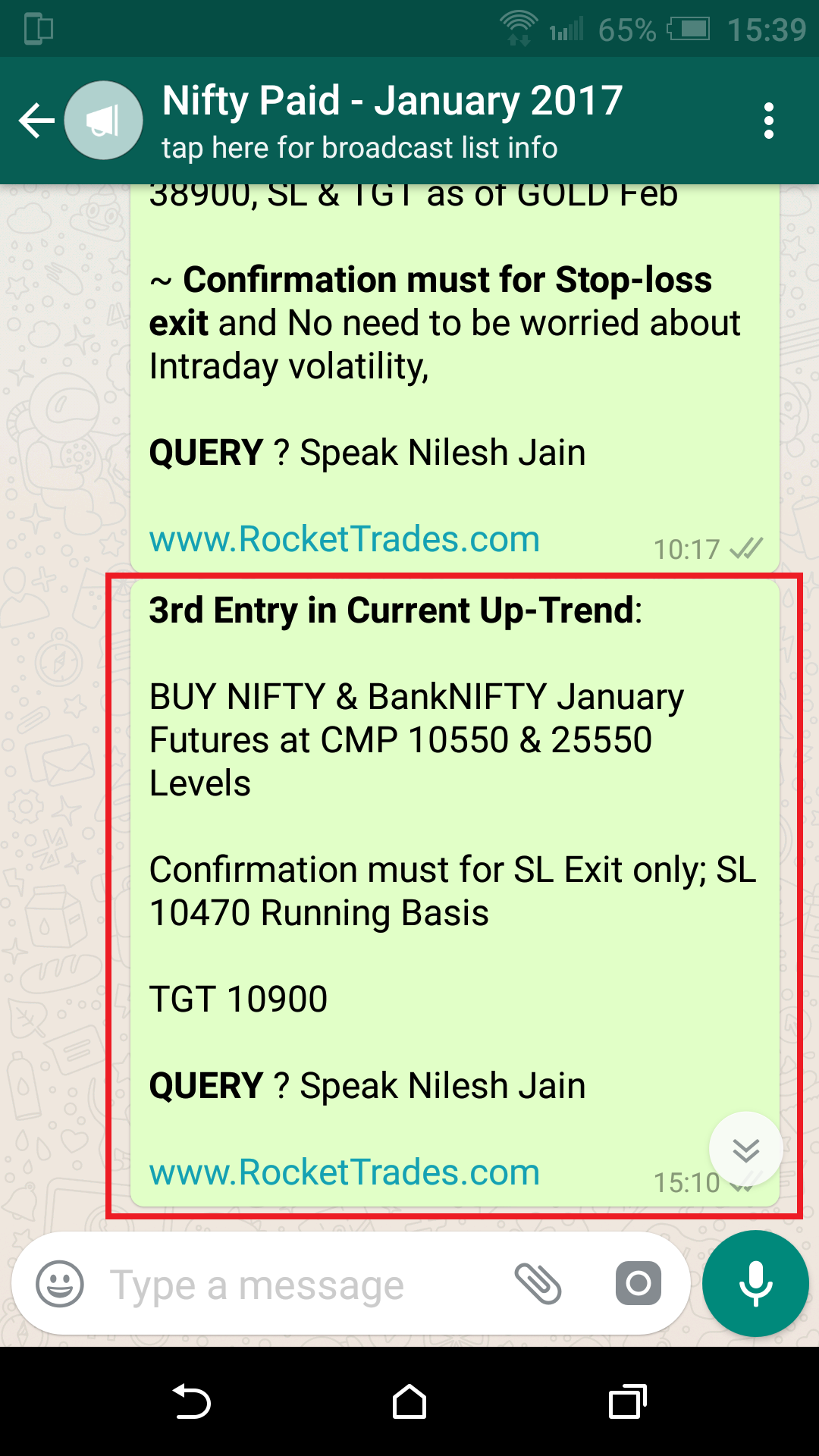

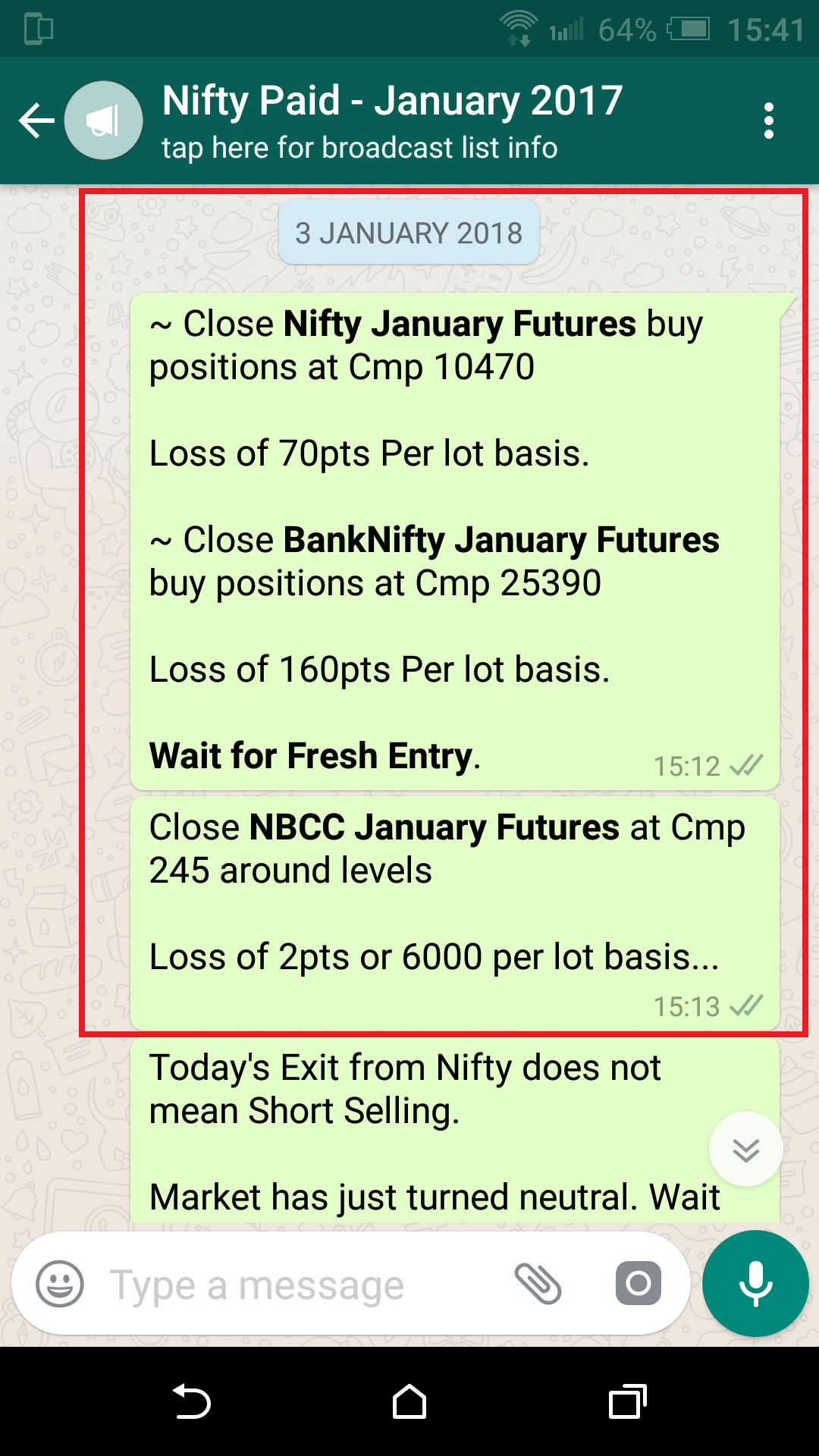

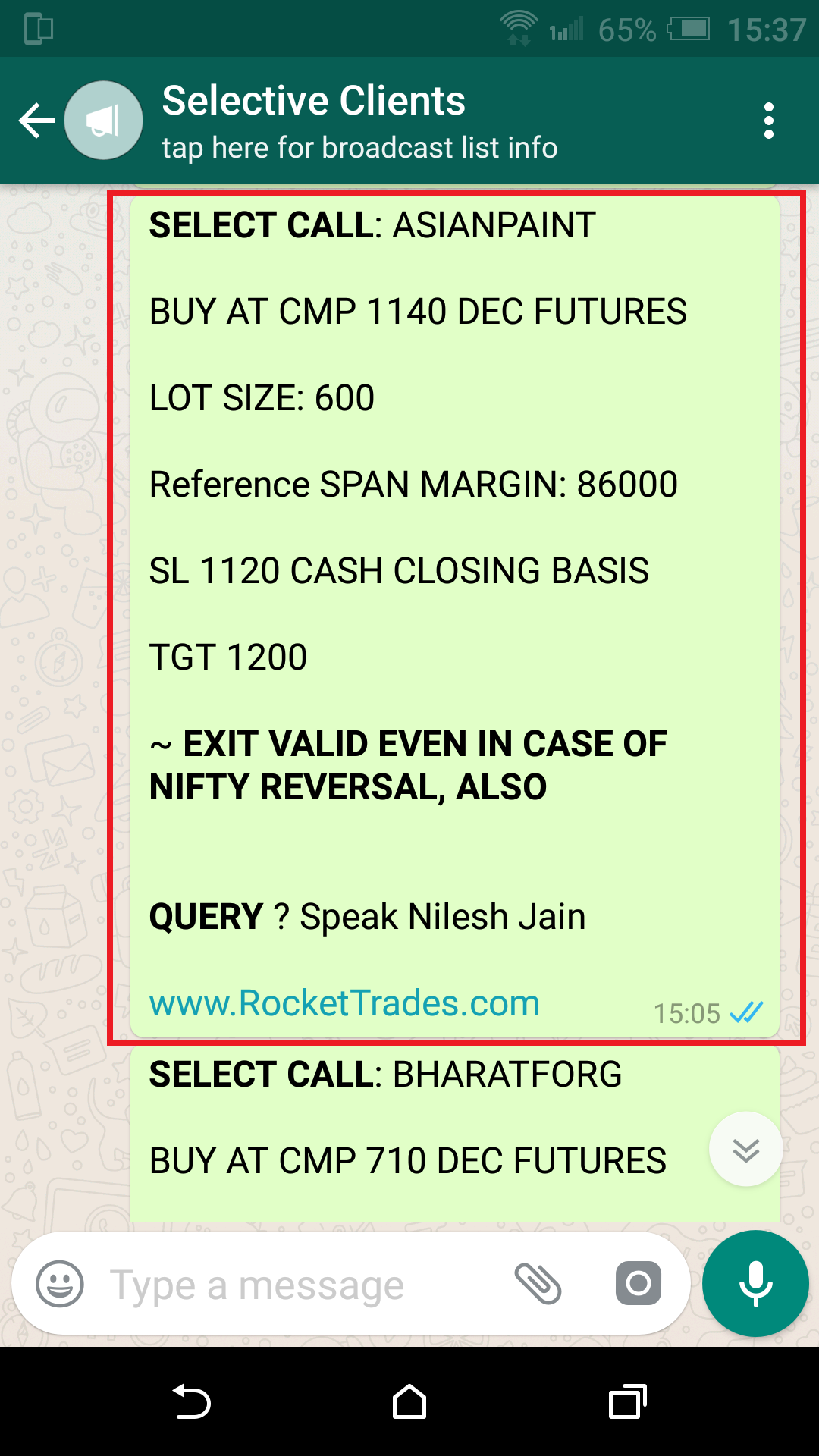

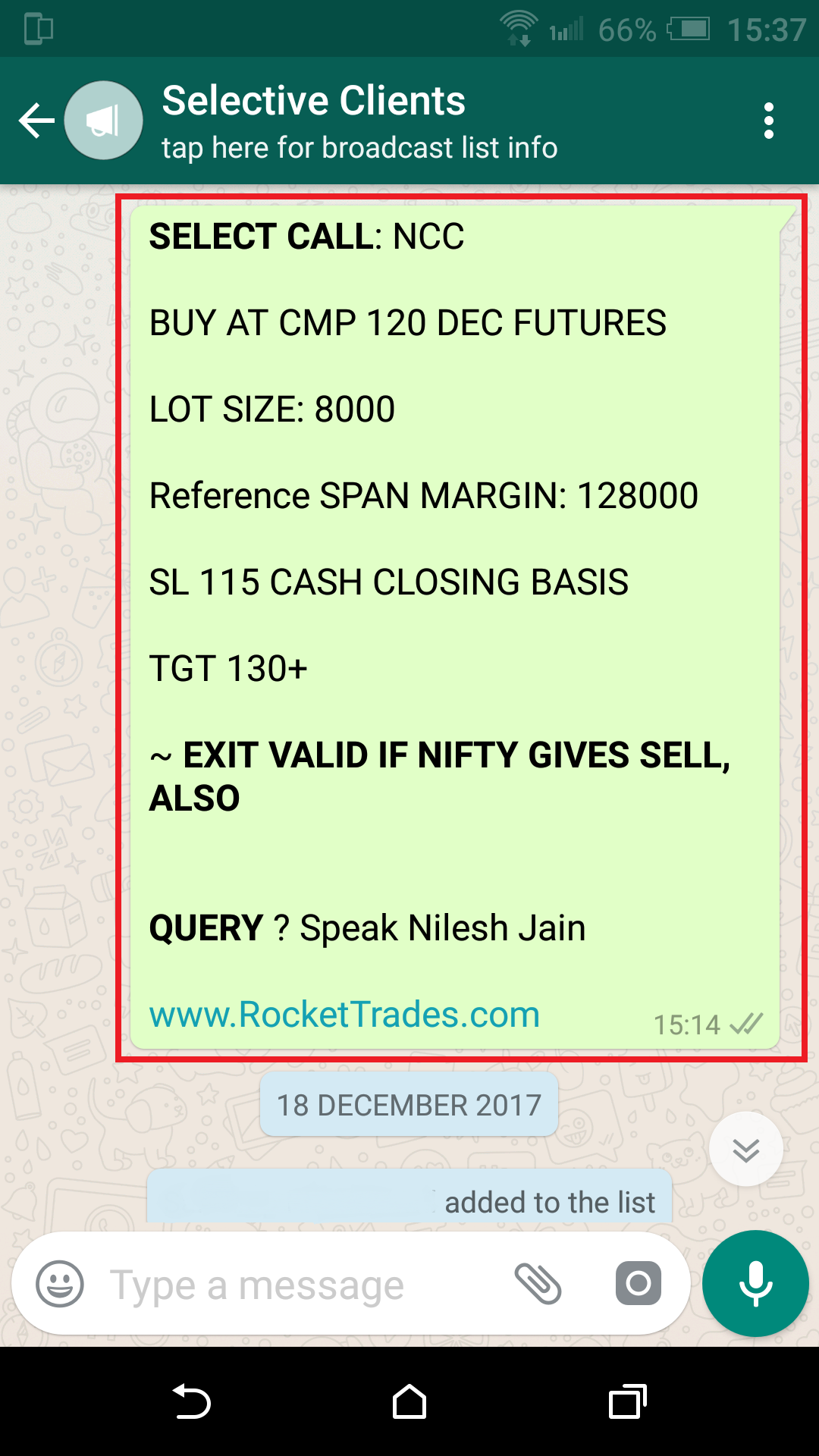

Therefore, Our Strategy is simple and Crystal Clear:

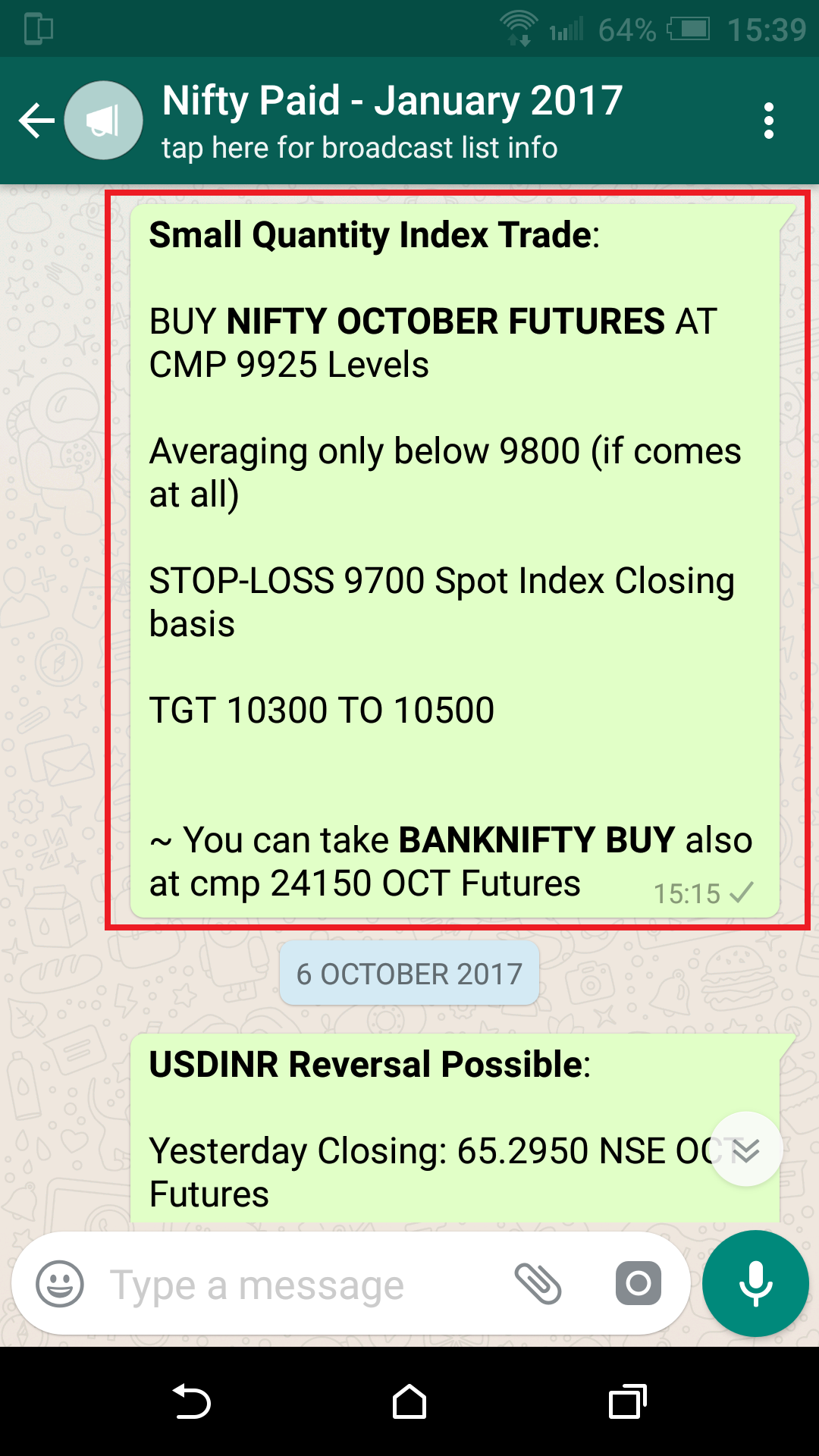

~ Under Bullish & Semi-Bullish Scenarios – Gives only BUY Positions in both Index & Stocks

and

~ Gives only Short Sell Positions in Indices, Stocks under Bearish & Semi-Bearish Scenarios

Secondly, Word over, First Two months (January & February) of every calendar year set the tone & trend for remaining 10 months; however, subject to country specific customs & economy practices. For Example INDIAN Budget, Investment allocations by both Foreign & Domestic Investment houses, etc…

Avoid treating above Statement as Thumb Rule; rather, it is a plain & simple observations.

Are YOU Prepared, enough ?

I agree, that Trading in Futures is risky but not equivalent to Casino Gambling. And, at the same time, useful instrument to manage/hedge Market risks during Down-Trend.

Remember that Blue-Chip, Large-Cap, Mid-Cap, Small-Caps, Long Term Investments, is all Jargon words and methods used to divert attention from day to day Market (Price) Volatility and/or prevailing Market Trend by the vested interests.

Better, Answer Yourself, what will happen to your Mutual Funds NAV (Net Asset Value) units in case of Market Falls, deep & sudden ?

In other words, false safety measures (justifying words like “Long-Term”) will not be useful.

We are not against long term cash investments per-se. Rather, we promote the same.

Only point which needs to be highlighted is that, even then, Entry “Pricing & Timing” is very much important in all those long term investments instruments, too.

That’s the reason why we keeps tracking Market’s Price action every single day, without fail.

Closing my write-up by wishing you to keep Booking Profits by Trading Safely !

Thanks for Reading.

Team Rocket

Get in touch with us at,

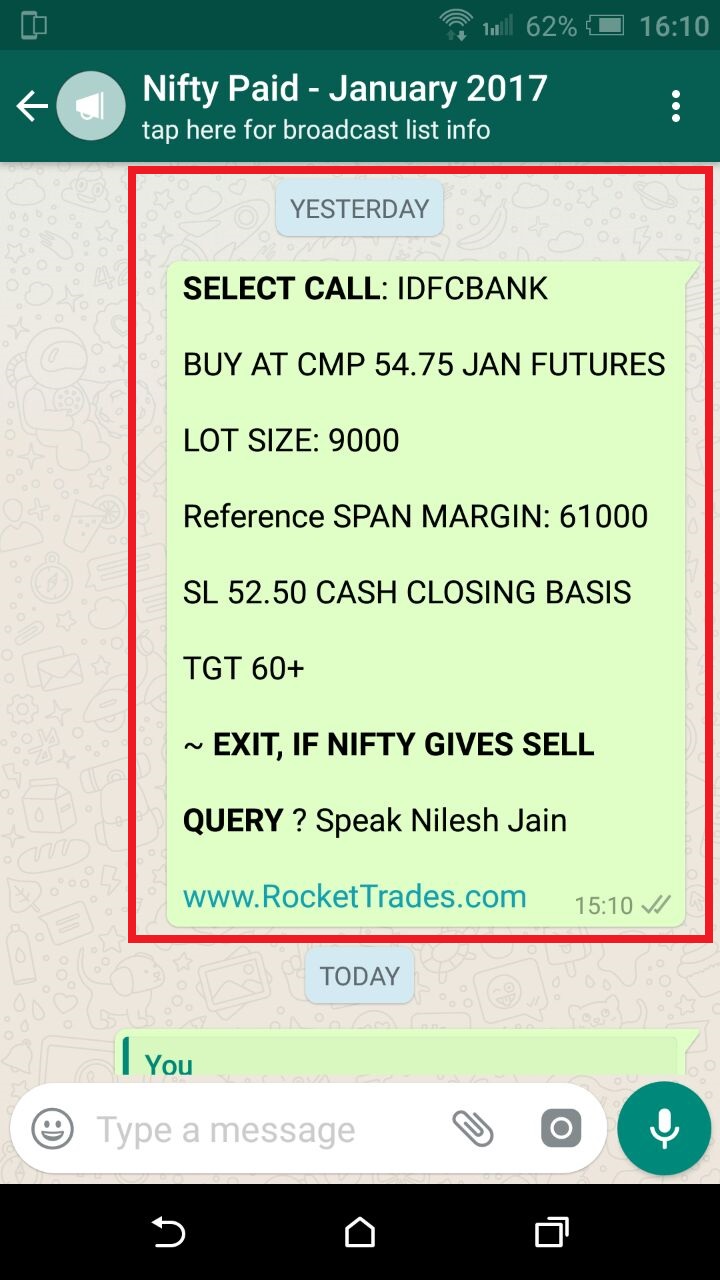

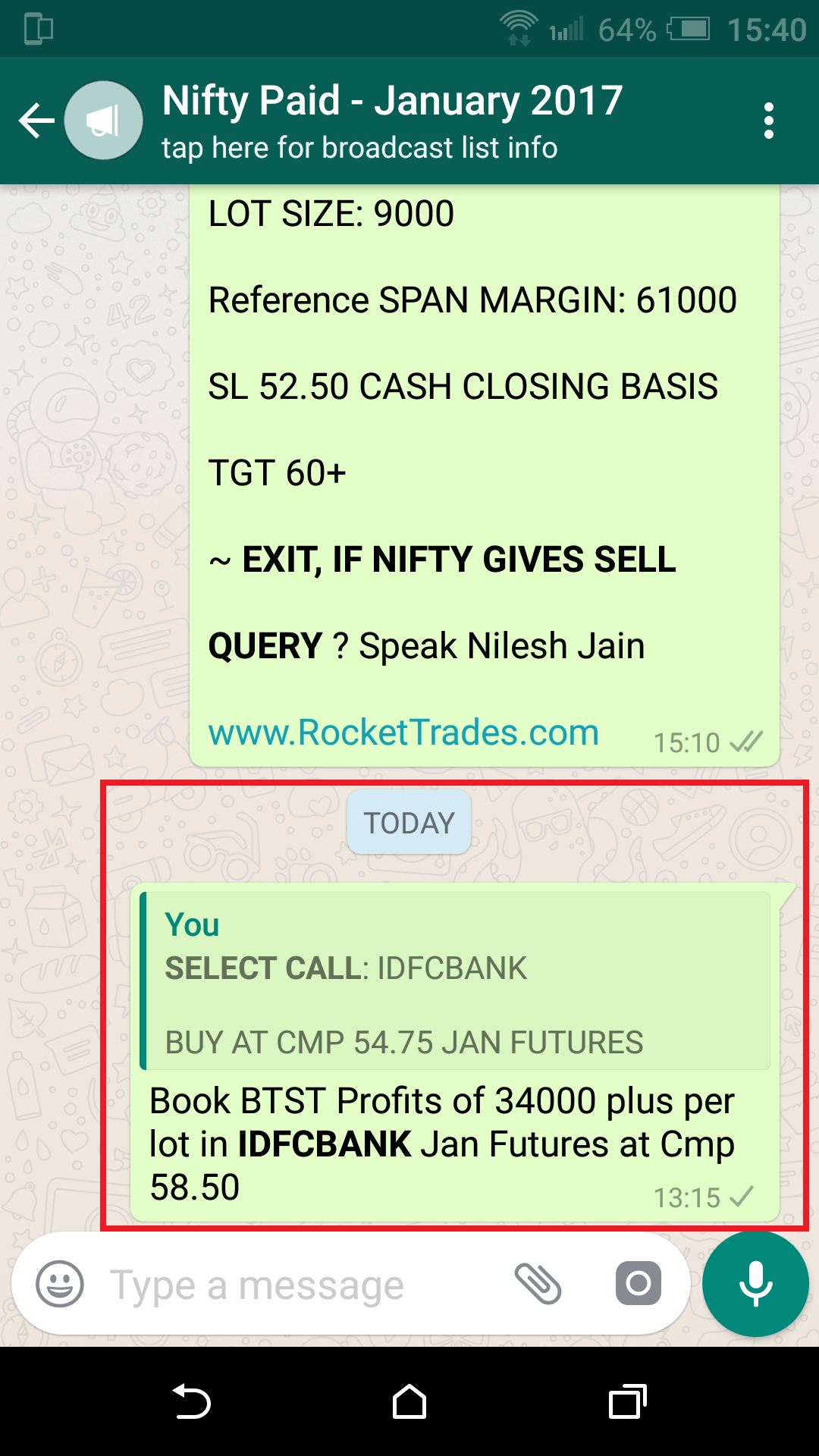

~ WhatsApp Number: 09900330558

~ E-Mail ID: Rocket@RocketTrades.com

For any more details, doubt, feedback; Speak with Nilesh Jain on 09900330558

You must be logged in to post a comment.