If you believe in India’s long-term potential, consider buying the stocks listed in Table One. India’s talent of solving problem and innovation makes it a wise choice. The current prices make it a favorable investment. This holds true even amid strong selling pressure from foreign institutional investors.

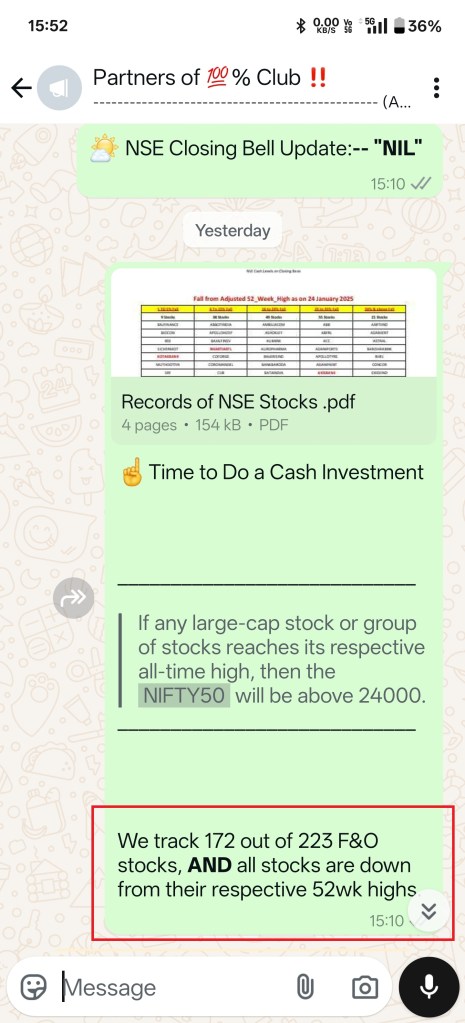

Screen Shot of WhatsApp Messages Sent to the Clients

We had updated 28000 To 31000 Target on the Last working day of Calendar Year 2024 🙂🙏🏽

Table “ONE”

| SL | Name of the Stock | Number of Shares to be Bought | NSE Closing Price As on 24 January 2025 |

|---|---|---|---|

| 1 | AXISBANK | 105 | 948.5 |

| 2 | BHARTIARTL | 61 | 1644.8 |

| 3 | HDFCBANK | 61 | 1649.8 |

| 4 | HINDUNILVR | 42 | 2368.1 |

| 5 | ICICIBANK | 83 | 1209.2 |

| 6 | IDFCFIRSTB | 1606 | 62.27 |

| 7 | INDUSINDBK | 105 | 950.8 |

| 8 | INFY | 53 | 1875.45 |

| 9 | ITC | 226 | 441.6 |

| 10 | JIOFIN | 409 | 244.45 |

| 11 | KOTAKBANK | 53 | 1886.2 |

| 12 | LICI | 122 | 821.25 |

| 13 | LT | 29 | 3458.2 |

| 14 | RELIANCE | 80 | 1246.3 |

| 15 | SBIN | 134 | 744.15 |

| 16 | SIEMENS | 17 | 5879.7 |

| 17 | TATASTEEL | 771 | 129.74 |

| 18 | TCS | 24 | 4152.35 |

| Total Investing Amount | 1798916.86 |

Please Note:

- This is recommended to allocate same amount of Investment in above-mentioned each Stocks respectively.

- Exit is only at & above 28000 NIFTY50 Levels or whenever Down-Trend Starts.

- Anyway, we will update Exit as well. Continue to hold in all situations & Conditions.

- If you prefer then trade in Futures and keep Rolling Over.

- Rolling Over will Increase Exposure Cost but will save Interest on Capital Invested. Trade-Off. But, Return On Investment will be much better.

- We have taken 100000 as Standard Investment amount. You can take 1,000 or 10,000 or 10,00,000.

- If everything goes according to our Research then one can expect 50%+ Returns by next year’s Budget.

- NIFTY50 is trading near June Top (before General Election Result day) and November 2024 Bottom. We feel the Market has seen its worst. But still we are keeping our finger crossed. 🤞🤞🤞

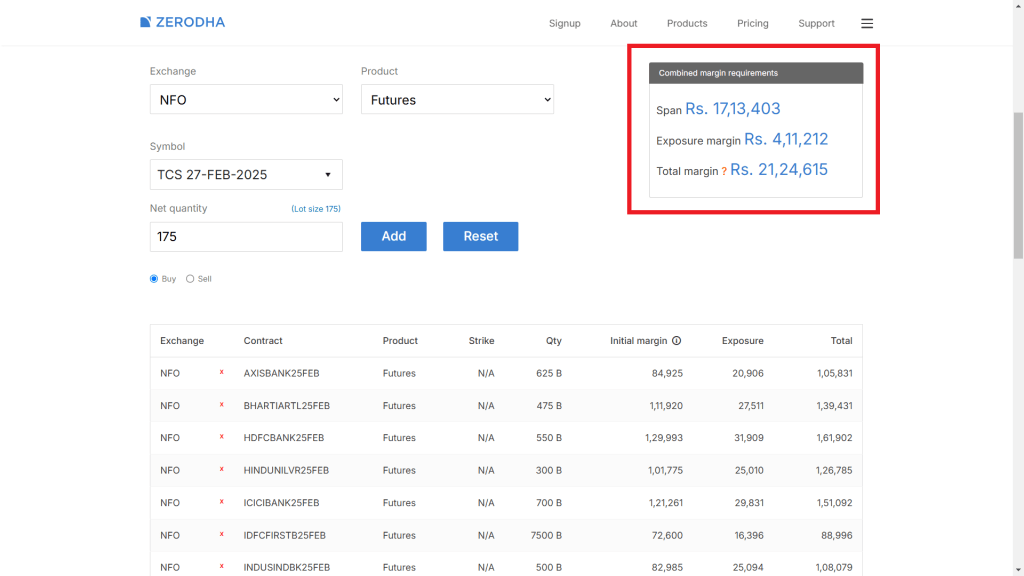

If above-mentioned Stocks are to be taken in the Futures then total Margin Required will be around “21lac” and plus Mark to Margin

👇

Rocket Trades

We are Strictly fee only Research House armed with proprietary methods & workings.

Call, Text, WhatsApp: +91 99003 30558

Trading Counsel, Support & Guide

SEBI RA: INH200002978, Bengaluru

E-Mail ID: Rocket@RocketTrades.com

You must be logged in to post a comment.