Greetings !!

Stock Market Participation is always inherently risky whether its by way of IPOs, Mutual Funds, ULIP linked Insurance Policy, ELSS Tax Saving Scheme, Direct Investment in well diversified Portfolio (self or professionally managed) and/or trading in derivatives.

Only difference among all of them is nothing but net risk amount (preferably represented in terms of percentage terms vis-à-vis total available capital, absolutely).

Before proceeding further more, please read preceded article by clicking on following URL

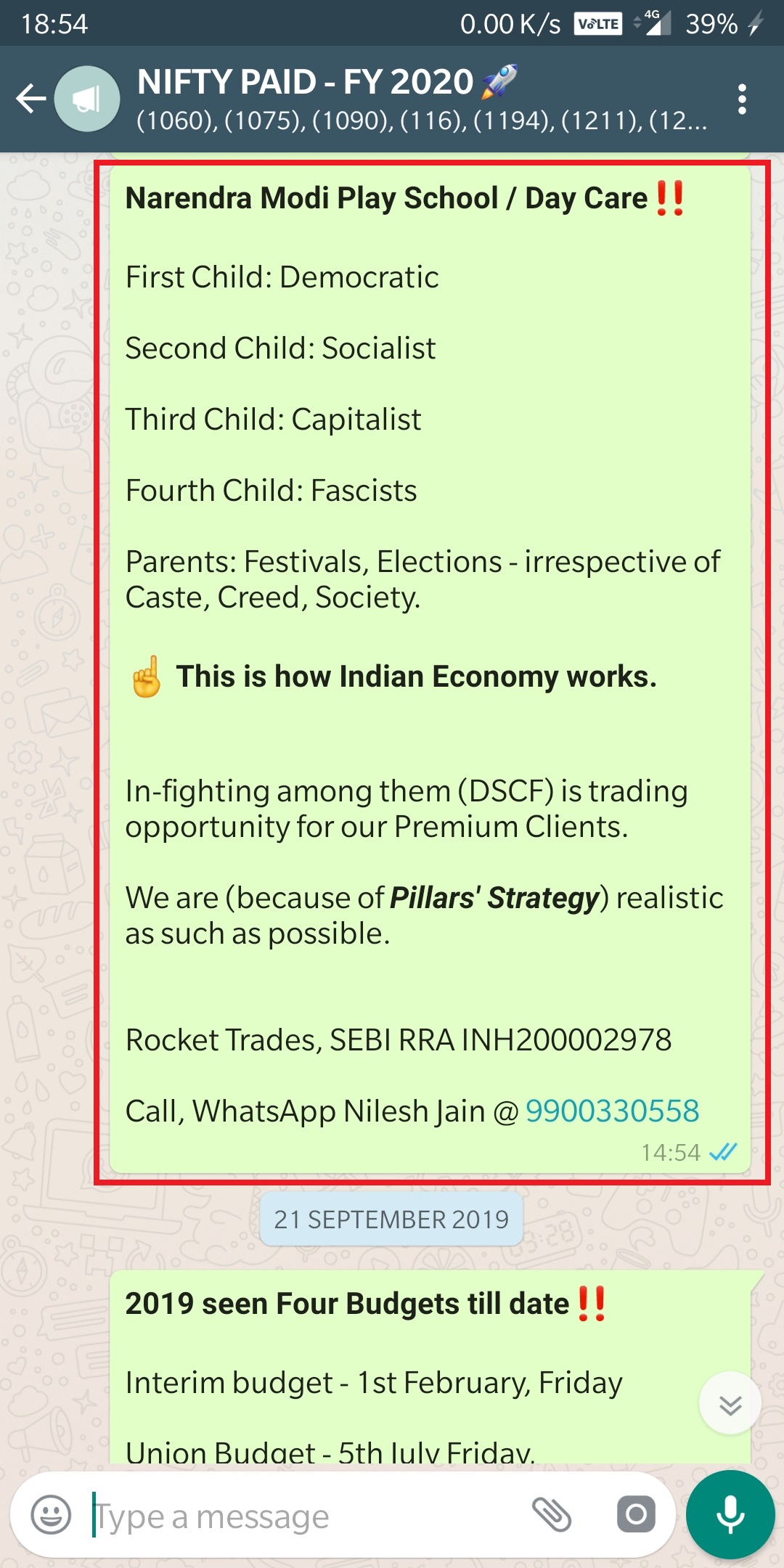

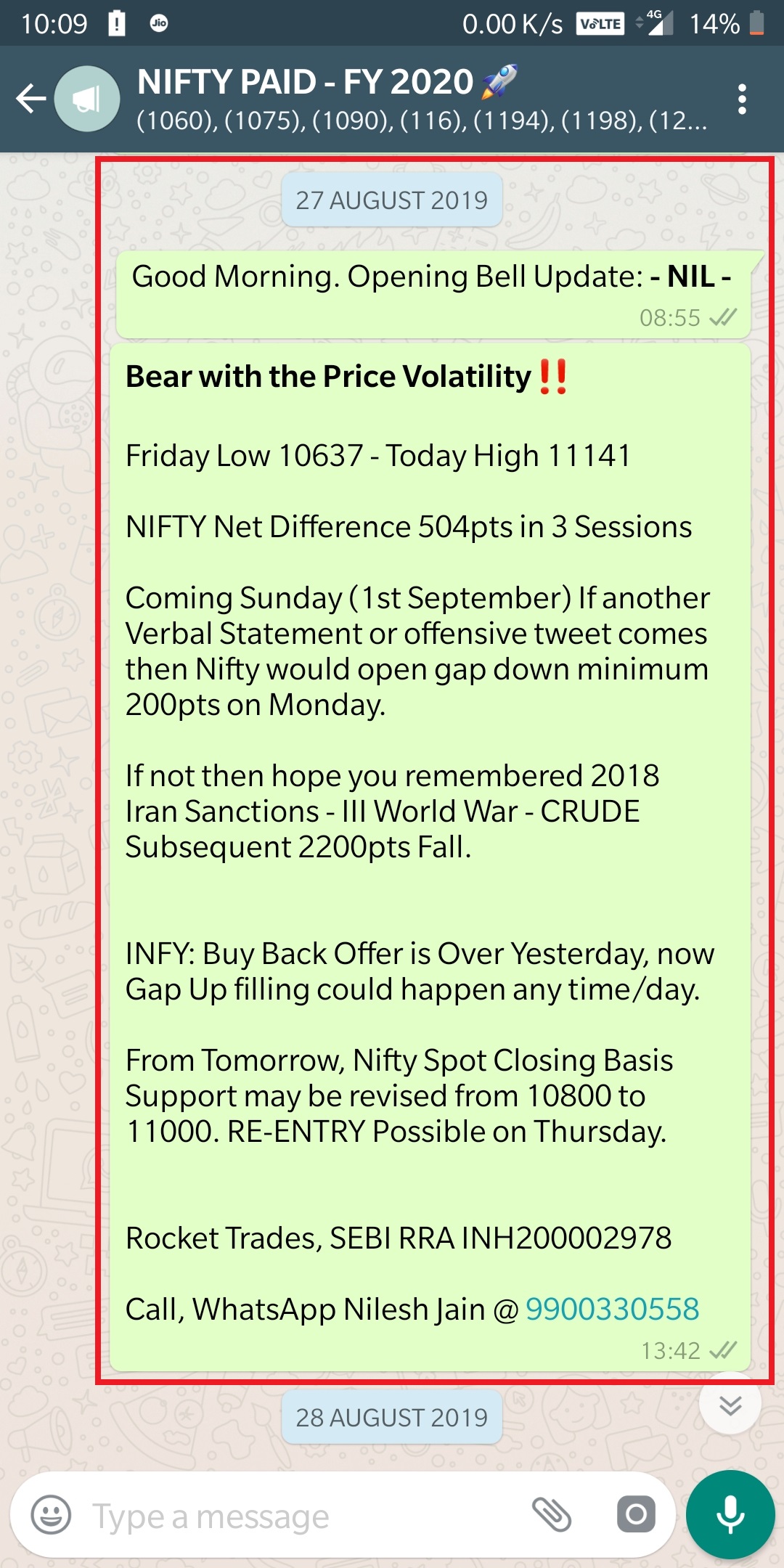

The real reason of Market Volatility is infighting among various segments. A vibrate democracy requires all sort of voices & noises but limitation (rather controlled approach) should be exercised. Anything which gets excessive would make things out of hand.

And, that exactly what happens at respective Market Tops & Bottoms, time & again.

Only democracy can give us sustainable long term growth but no compromise is acceptable on two counts First: Education and Second: HealthCare in all sense & means.

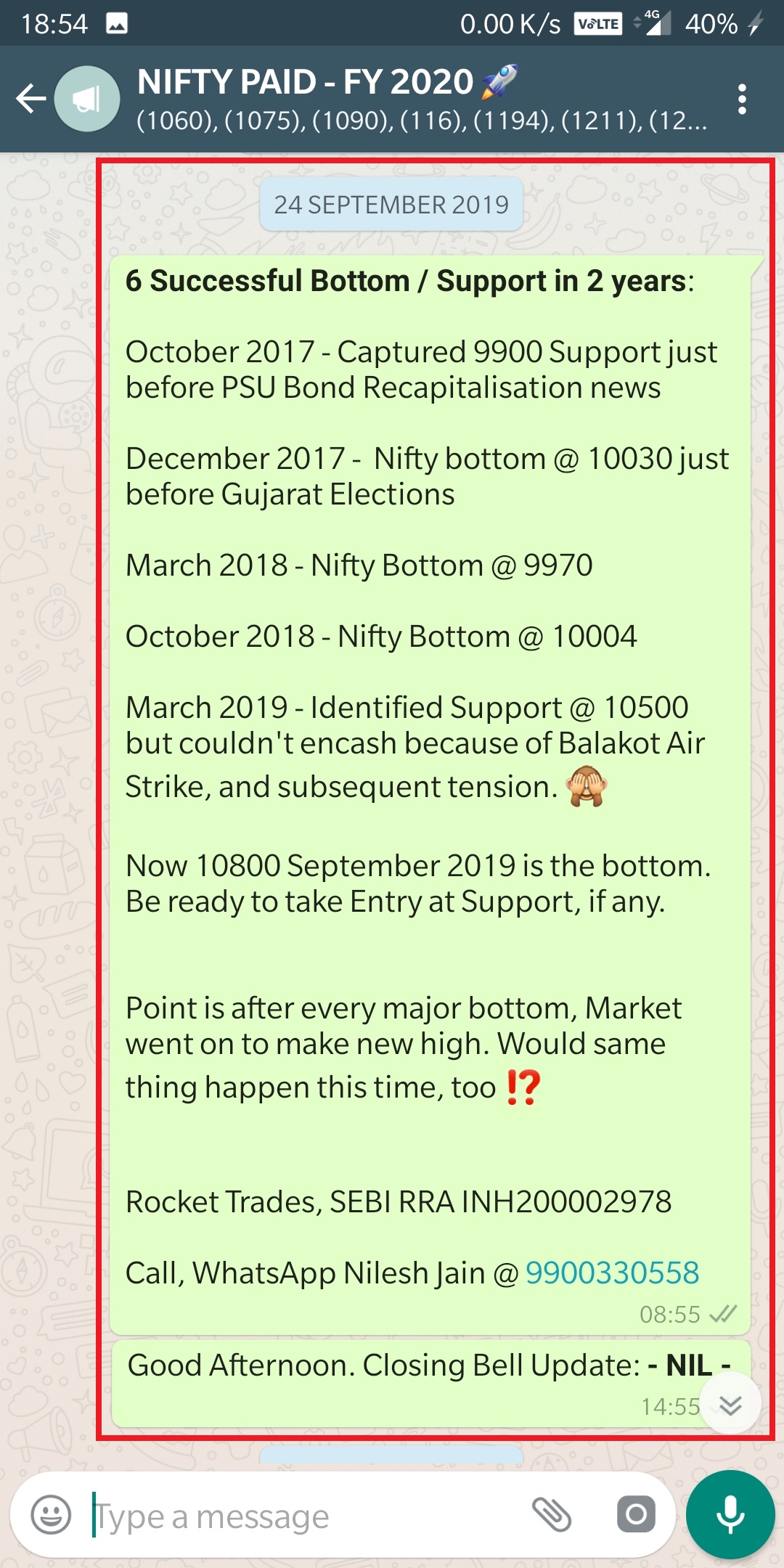

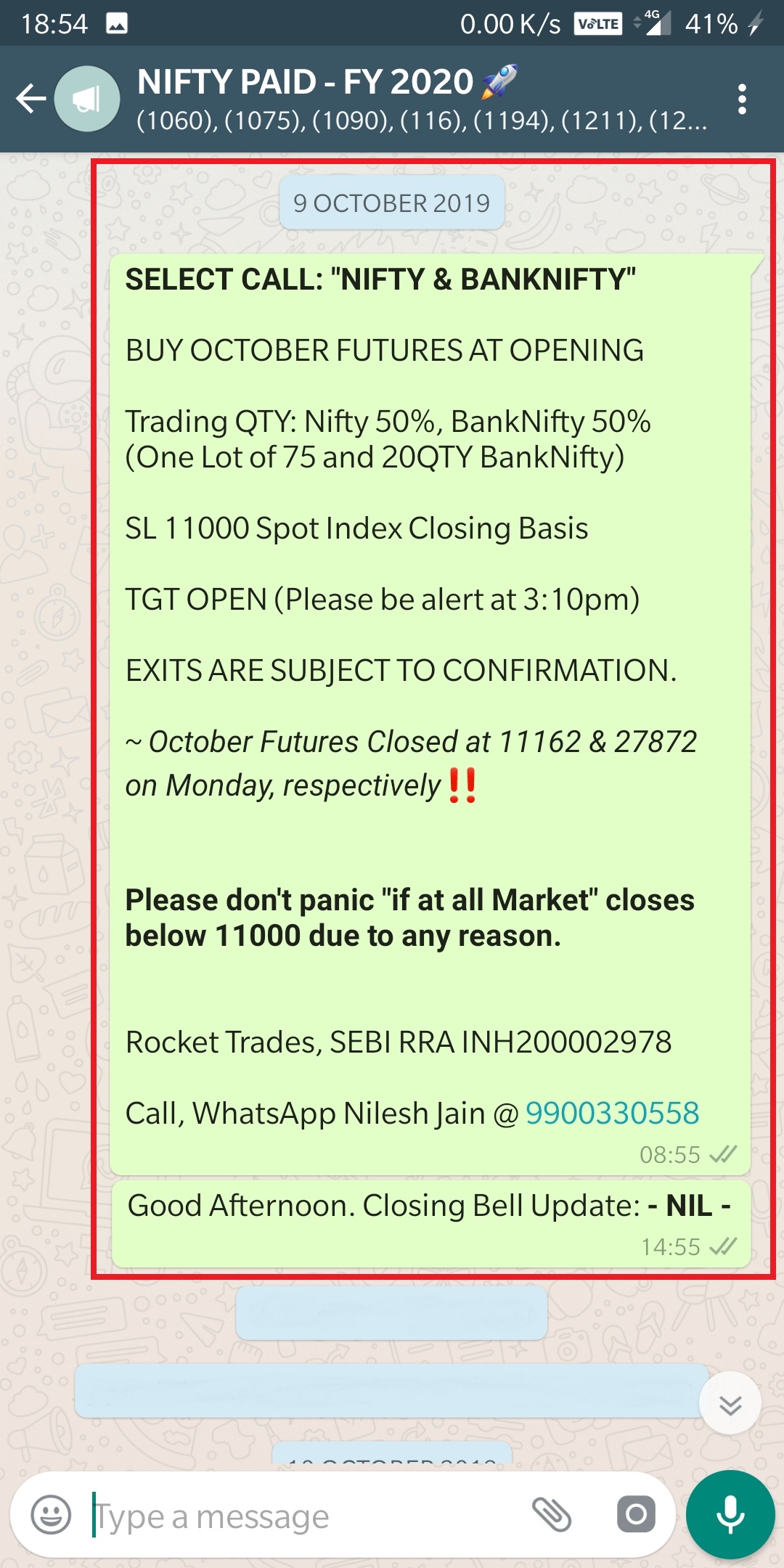

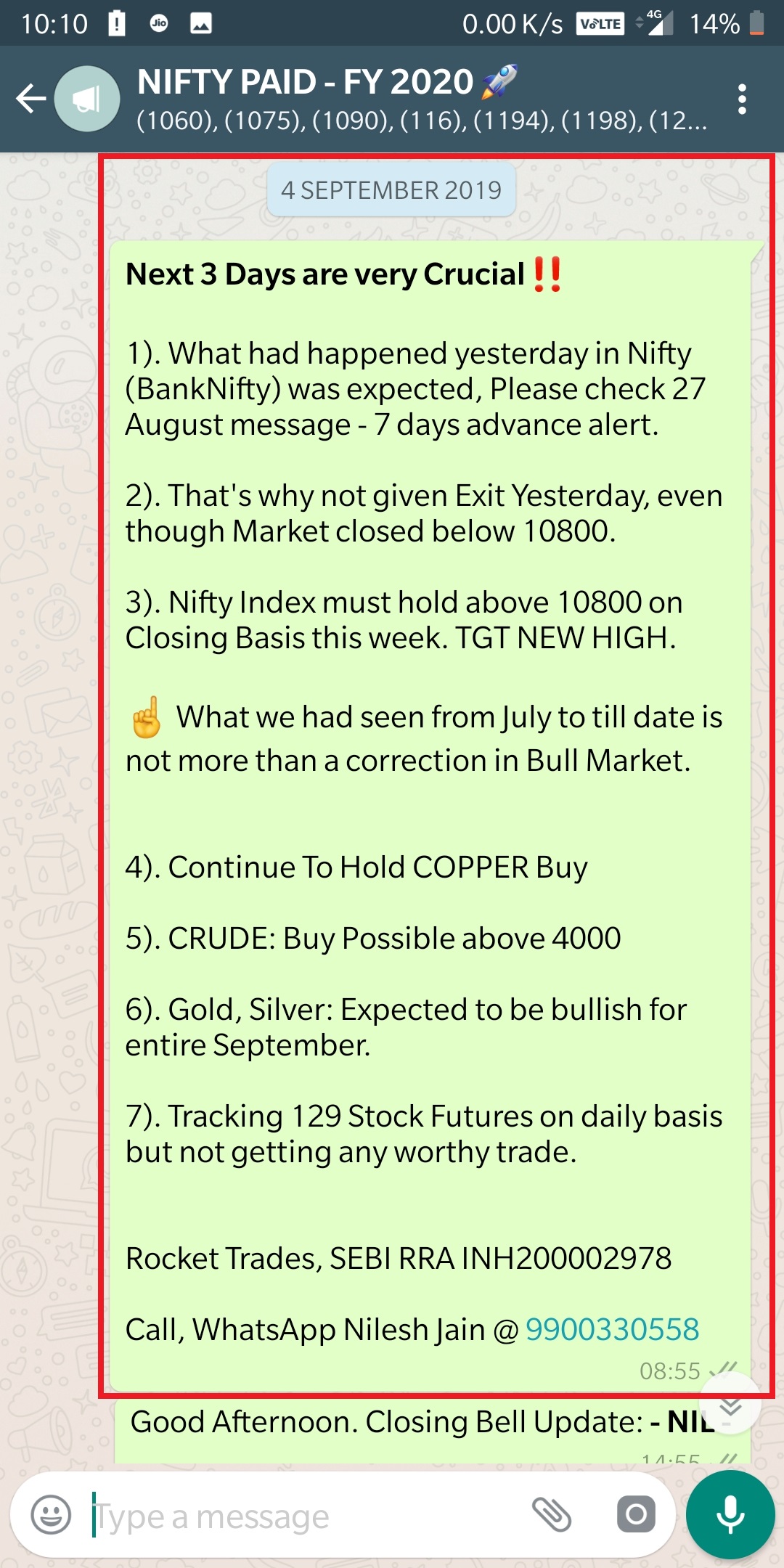

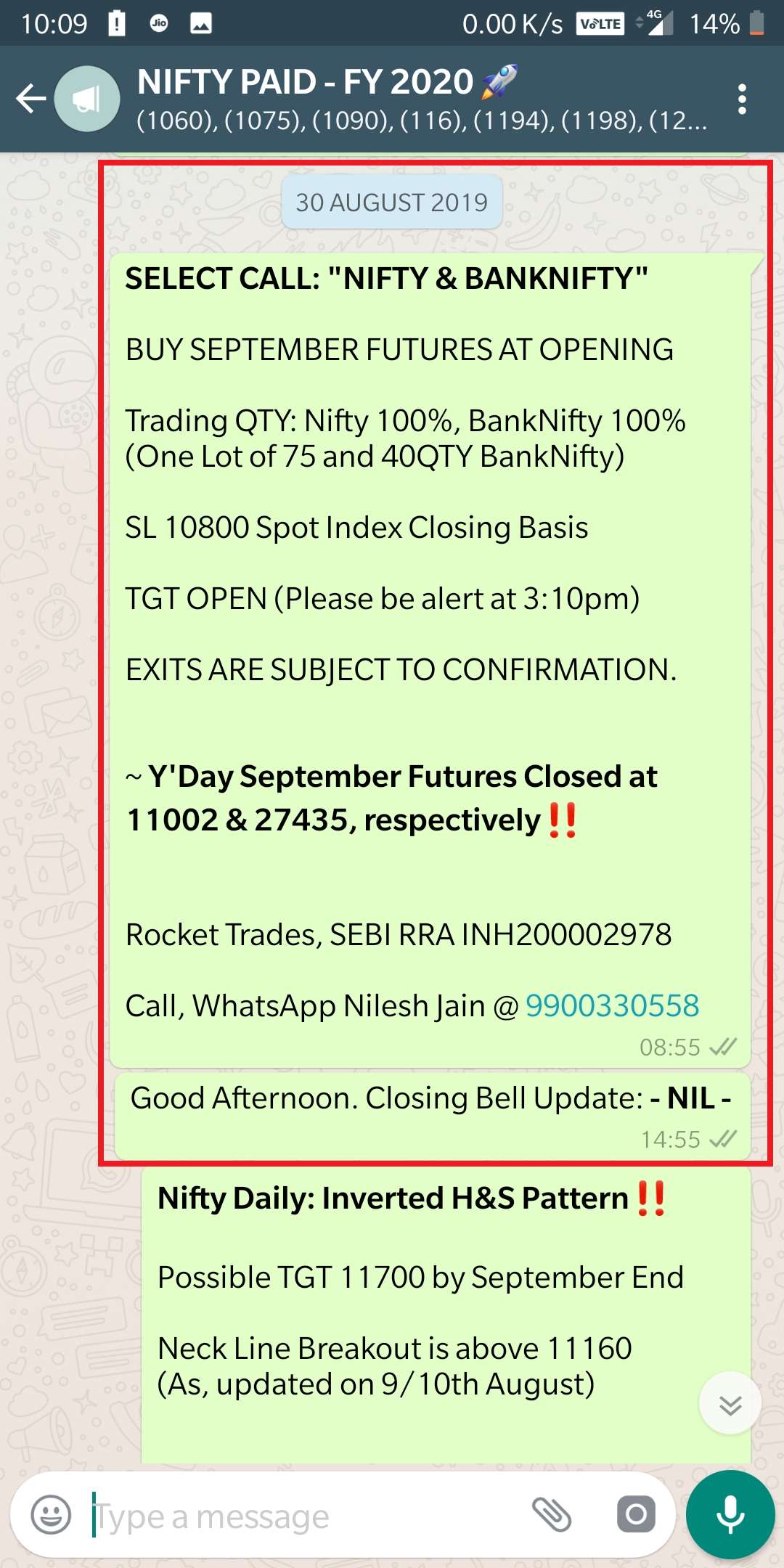

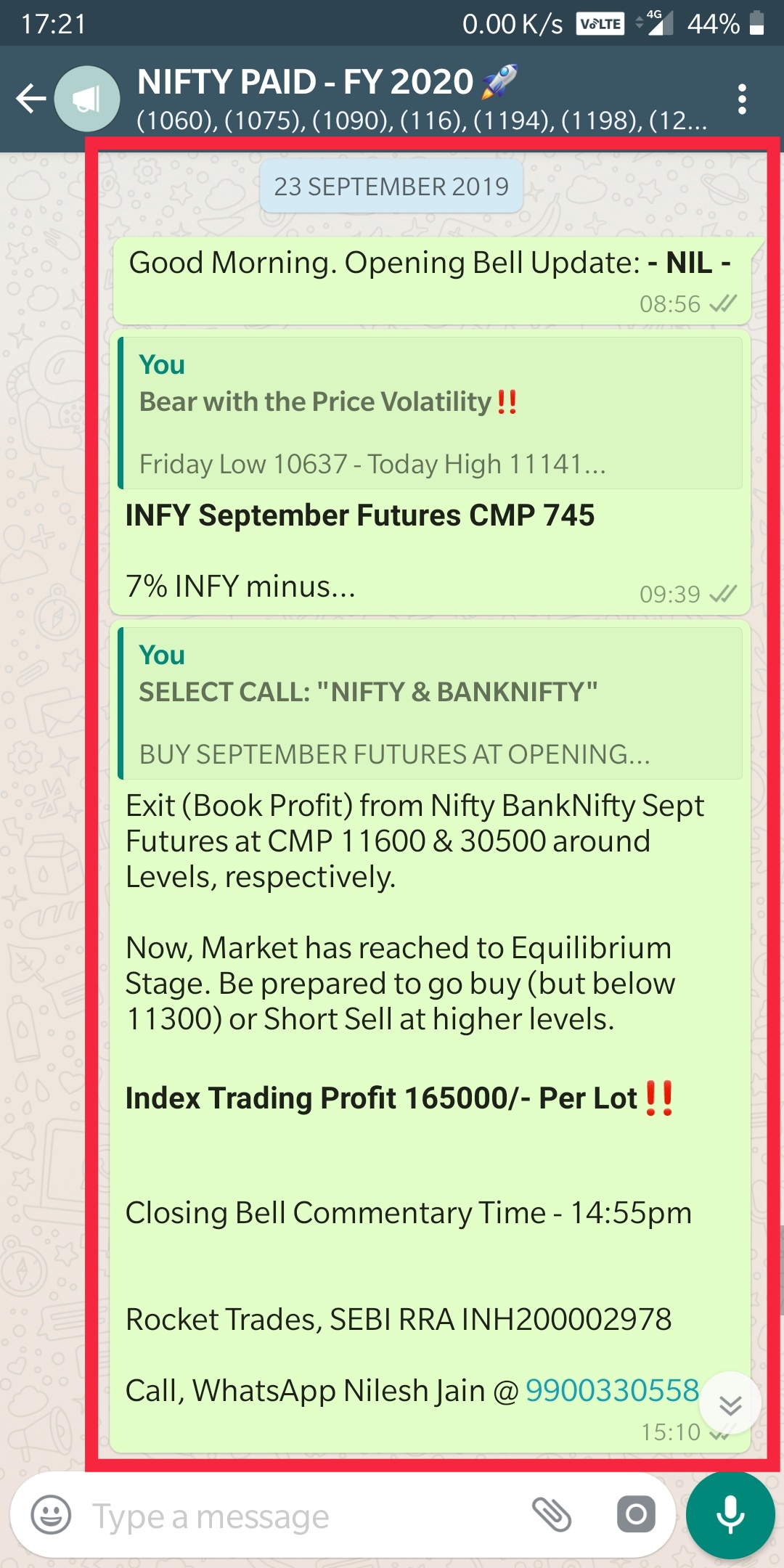

Market was kind enough to obliged us and did exactly in due course as being mentioned and outlined in our 24th September Message (right hand Screen Shot – “6 Successful Bottom / Support in 2 Years”).

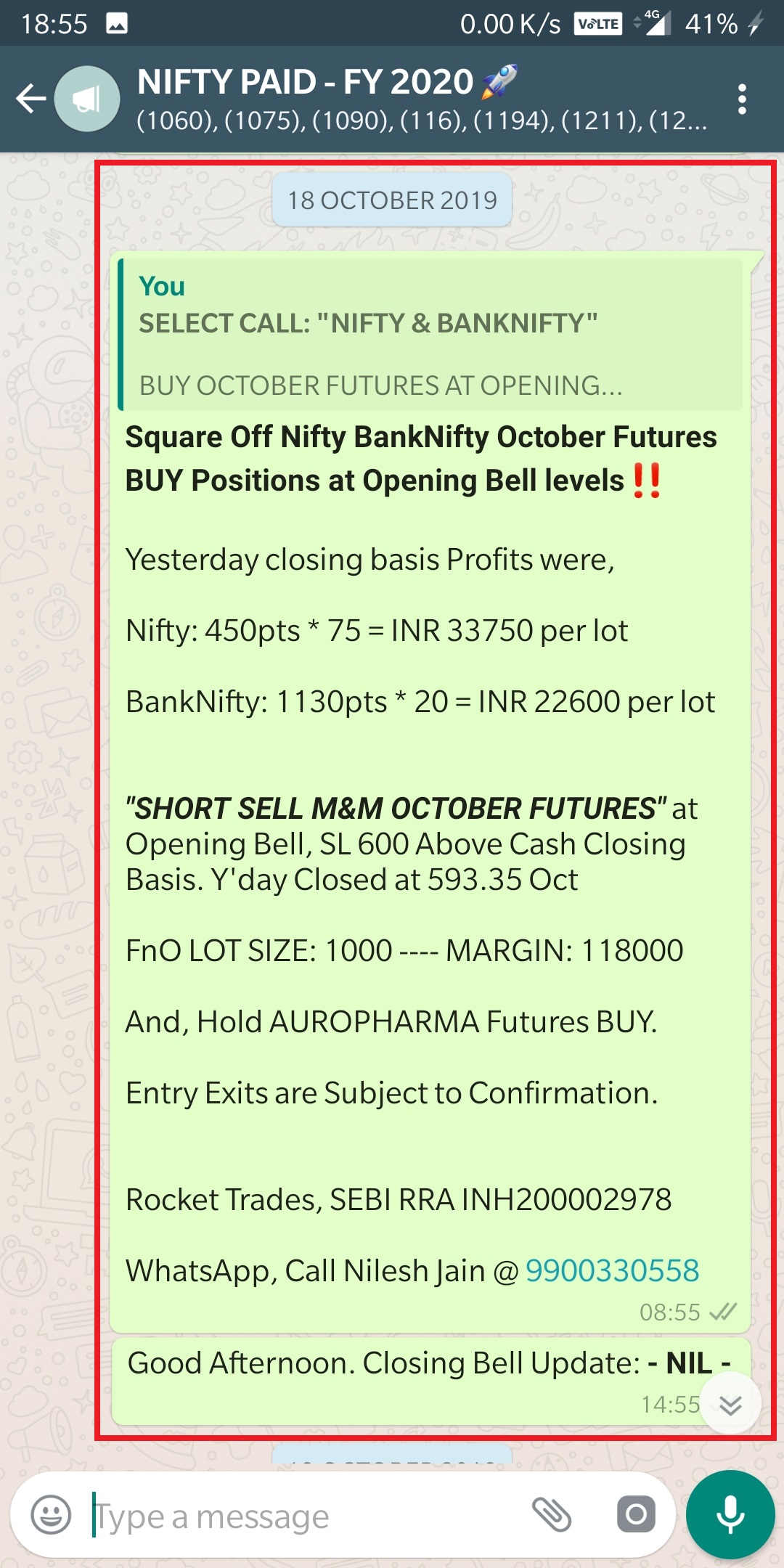

Another INR 55000/- Profit Booked in 8 Calendar Days:

Earlier Profit of 169000 + this 55000 equals to INR 224000 /- on initial investment of 2.6lac

This is how we generated near about 87% return on trading capital in 48 calendar days.

Remarks:

1). In no way, we are suggesting that Pillars’ Strategy will never eve give you losses and/or always generate 100% return on trading capital. All we are suggesting that BE POSITIVE.

2). The entire purpose of this post is to share actual workings of real paid clients.

3). We may (or may not be) better up this performance in next round of calls/advises.

4). Rest assured, we are constantly improvising our performance.

5). We strictly avoid Intraday and Options Trading. We Prefer only Positional Futures.

6). Pillars’ Strategy is in-house developed and exclusively used for clients; neither using 3rd Party Software nor any data source related to them.

We’re Strictly a Research House armed with proprietary methods & workings.

Thanks for Reading.

Team Rocket

Get in touch with us at,

~ WhatsApp Number: +91 99003 30558

~ Official E-Mail ID: Rocket@RocketTrades.com

For any more detail, doubt, feedback; Speak with Nilesh Jain on 99003 30558

You must be logged in to post a comment.