Old tactics simply don’t work in this new age of Stock Market, and both of us (Advisor – Traders) would be wise to recognize this.

Like it or not, this new age is here to stay.

Underperformance To Outperformance in 69 Working Days.

- Those FOLLOWED Market Volatility incurred loss of 50000

- Those FADE under Market Volatility – Booked Zero Loss but Zero profit also.

- And, those who FOUGHT with us, dare Market Volatility finally booked profit of ₹99,000/+

Holding all those 101 days were not easy but worth it if we see the rate of returns.

Background:

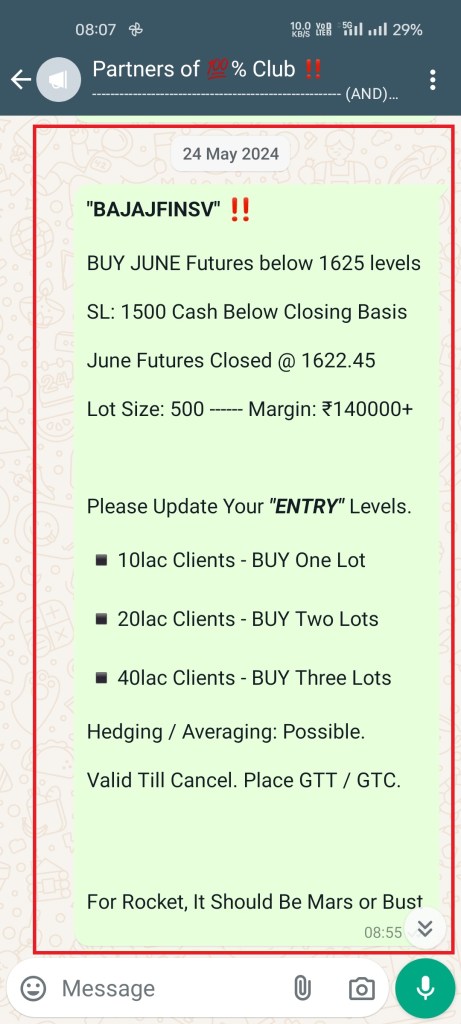

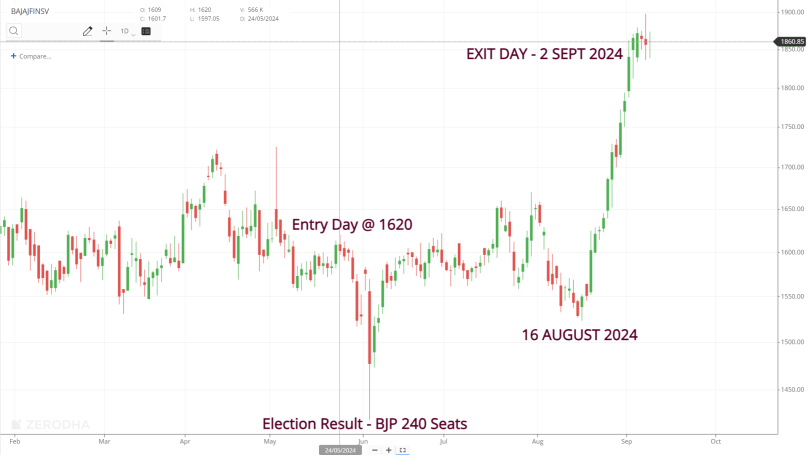

Originally BAJAJFINSV buy was advised on 24 May 2024 in June Futures at 1620 levels.

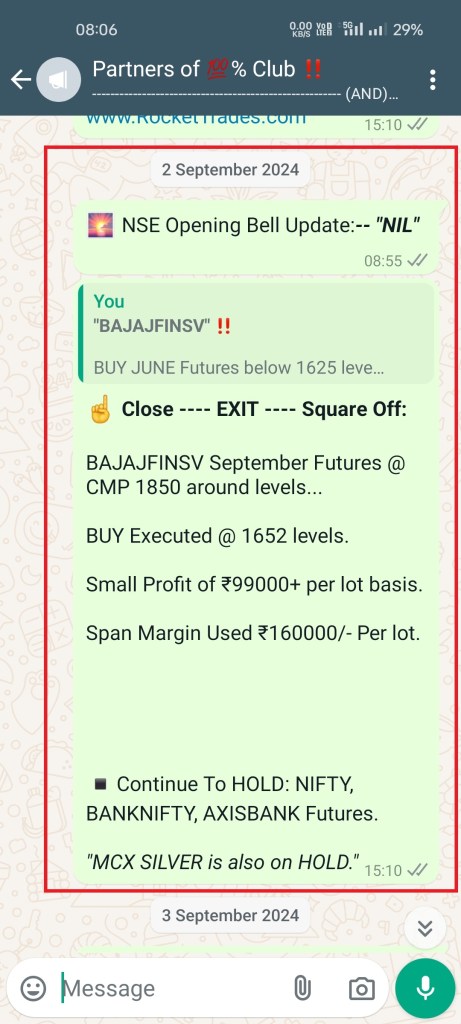

Thereafter, Rollovers to July, August and September Futures.

After all those rollovers the net Cost increased to 1652 from original Cost of 1620.

Originally invested ₹127000/- towards span Margin, which with time increased to ₹160000/- and many days we have seen MTM negative balances.

However, net result was positive so no harm came to Clients (ofcourse who fought to Market volatility with us) by keeping such a long holding.

Choice is Yours.

Market volatility will not go away. That will always be there. Without that volatility Market can’t and will not function. Because, All profit loss is direct byproducts of that market volatility.

in straight words —— No Volatility No Profit No Loss.Pick your side —— Follow, Fade or Fight.

IF your decision is to fight then be prepared to lose 30% of your capital. But, reward can also be 100%. Expected Timeline 12 To 18 months.

This BAJAJFINSV trading call is a live example for future that one can see

Loss of ₹50,000/- to profit of ₹1,00,000/- per lot basis, and,

All these in just 101 Calendar Days or 69 Working Days…

During those 101 days, what not we saw. General Election Results, Budget, Independence Day Speech, Quarterly Results, RBI FOMC Meet, Geopolitical Issues, SEBI vs Hindenburg, etc.

We paid 30pts plus premium for rollovers.

Point is very simple, Market will Move when it want to move. It is not in control of anybody, that means no analyst or analysis method can forecast precise timing each time for one particular instrument or all for that matter.

In this BAJAJFINSV case, from 1520 To 1860, that good 340pts price movement happened in only 12 working days, that is from 16 August 2024 to 2 September 2024. And, on all other working days it was just trading negatively.

Conclusion:

Trading or Investment does not Get Rich Quickly scheme or Stock Market is not that easy what has been imagined or made out.

In the same way, the Stock Market is not a bad place.

Your patience and discipline will show whether Stock Market is bad or good for your financial health.

Lastly, If anyone wants quick positive results then better they should stay out of the Stock Market.

Because, If we look at the 20-year return of our broad market, it is about 13% plus. If people are coming with 200-300-500% return expectations, then they are likely to be disappointed.

Remarks:

1). All levels are of NSE Cash.

2). Attached Chart is from Zerodha Kite App.

3). This BAJAJFINSV case study is just for the Records and / or educational purposes like all other articles updated on blog till date.

4). Pillars’ Strategy is in-house developed and our core of all the decisions namely BUY, SELL, HOLD.

5). No doubt that BAJAJFINSV indeed closed below our given Stop-loss at 1500 on 4th June 2024 (General Election Results Day) but we didn’t book losses rather advised BUY in NIFTY June Futures at 22080 levels and continued to hold BAJAJFINSV with BANKNIFTY Futures as well.

6). If any reader of this article have any question or doubt about this article or Rocket Trades’ website then please contact Mr Nilesh Jain for the Support, Guidance and / or Clarifications.

BAJAJFINSV – ENTRY & EXIT MESSAGES

Rocket Trades

We are Strictly fee only Research House armed with proprietary methods & workings.

Call, Text, WhatsApp: +91 99003 30558

Trading Counsel, Support & Guide

SEBI RA: INH200002978, Bengaluru

E-Mail ID: Rocket@RocketTrades.com

You must be logged in to post a comment.