Quarterly Performance – July August September of 2021

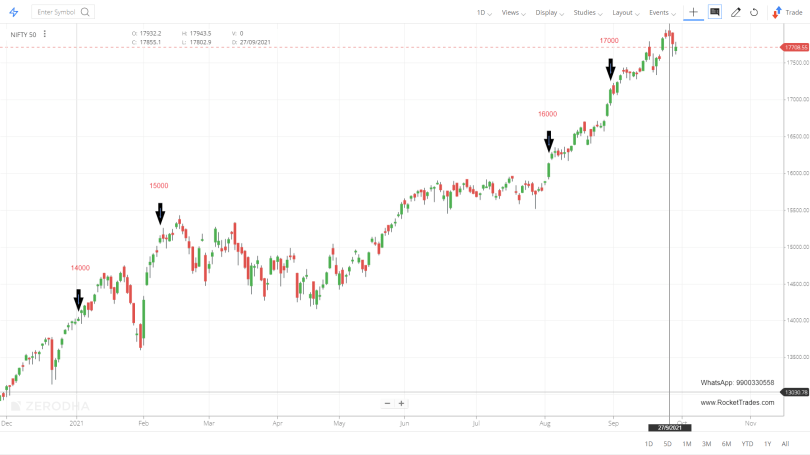

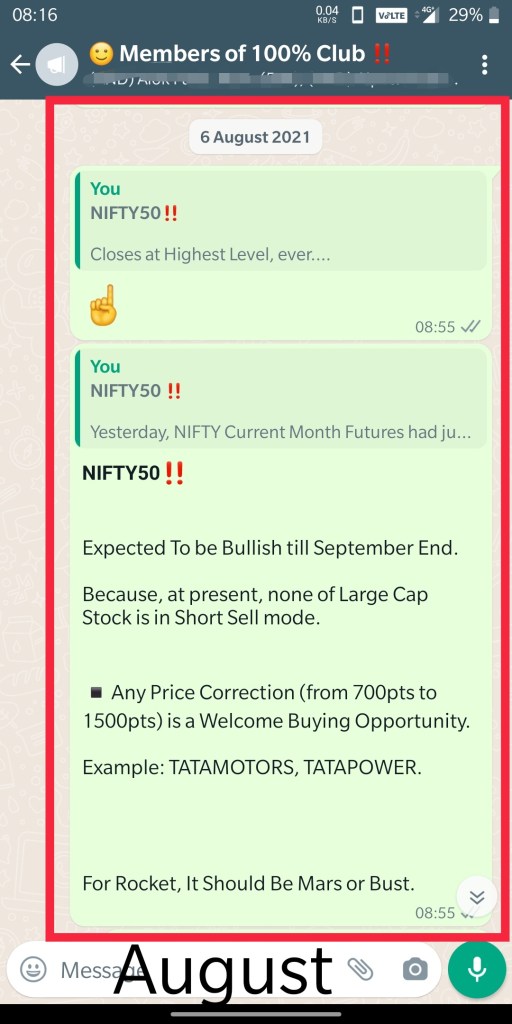

During this quarter NIFTY50 moved up 2000pts – and this was one-way rally. No Correction, No Pullback, even after Covid-19, China Uncertainty. Nothing.

Mind you, every single point above 16000 was an all time high.

Here are the Stats: 1st July NIFTY50 closed at 15680 and on 30 September NIFTY50 closed at 17618, highest point was 17947

Back then lots of worries surrounded the market like Historically RICH Valuations, Global Uncertainty including China Crack Down on Internet Businesses and impending Default of Evergrande.

Above mentioned development were making us uncomfortable because on one hand NSE was at New High almost every day and on other hand Global Markets were sending negative feelings.

But, then we experienced the true power of Pillars’ Strategy – “STOP-LOSS” our Plan “B”.

Executive Summary:

- Losses Booked

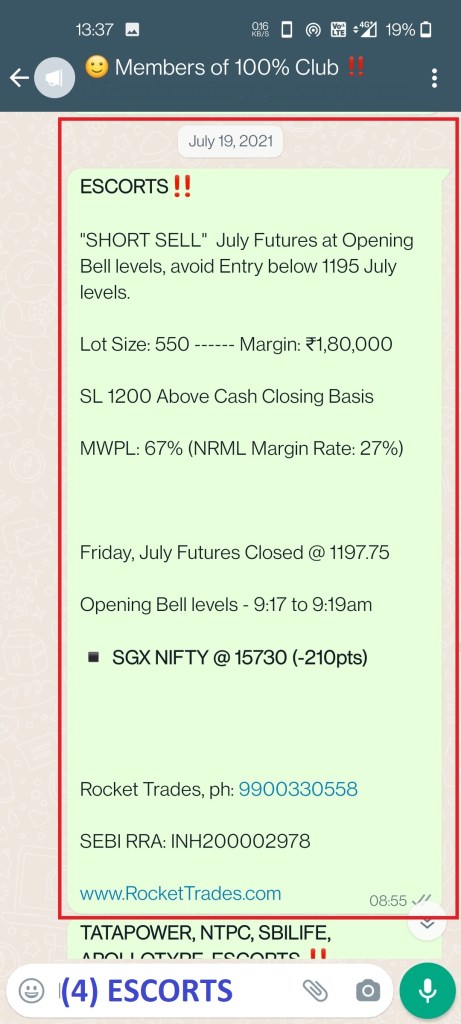

- ESCORTS: Short Sell Call

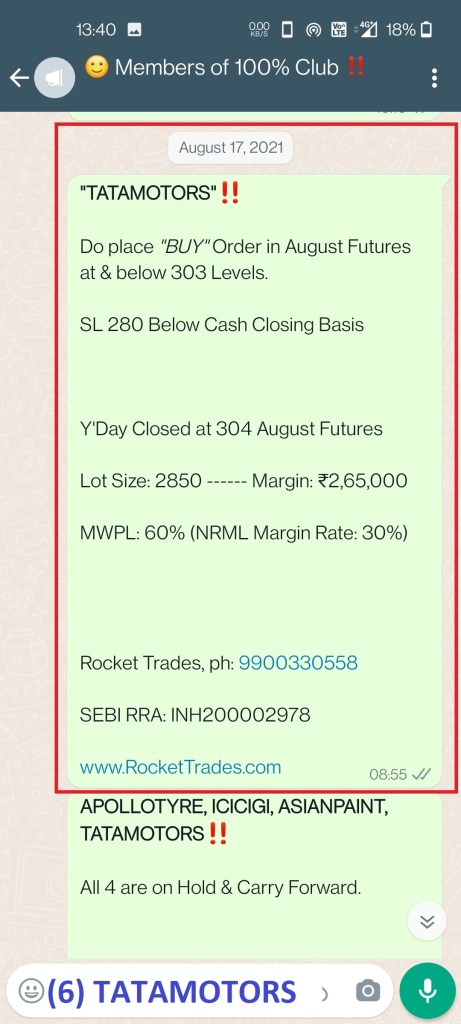

- TATAMOTORS: BUY Call

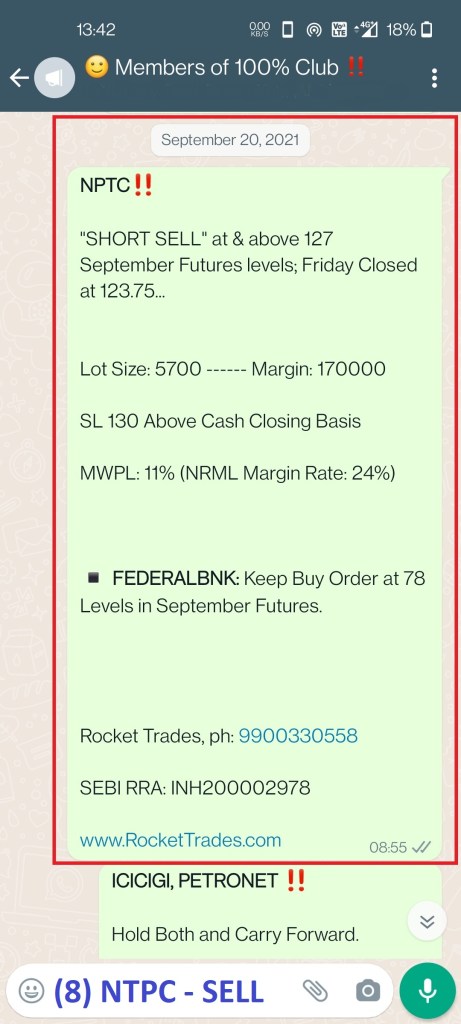

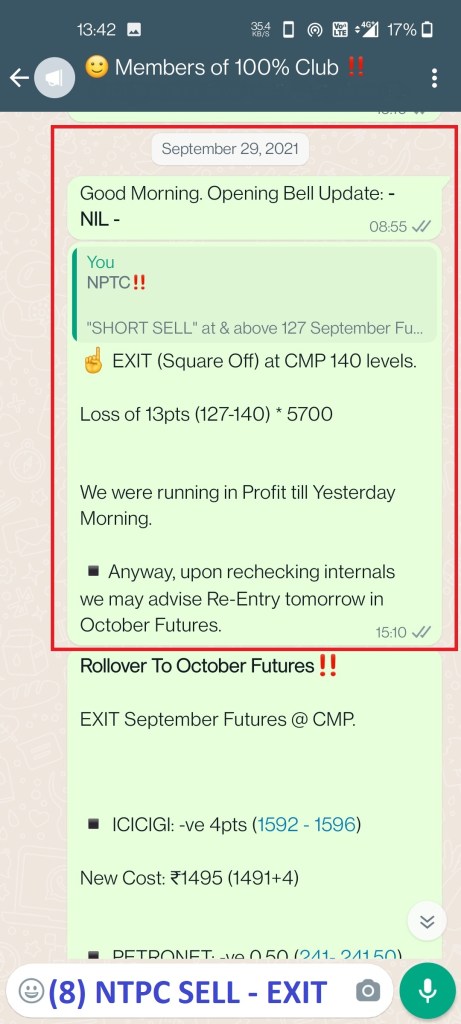

- NTPC: Short Sell Call

- IRCTC: Short Sell

- Profitable Calls were, 🎉

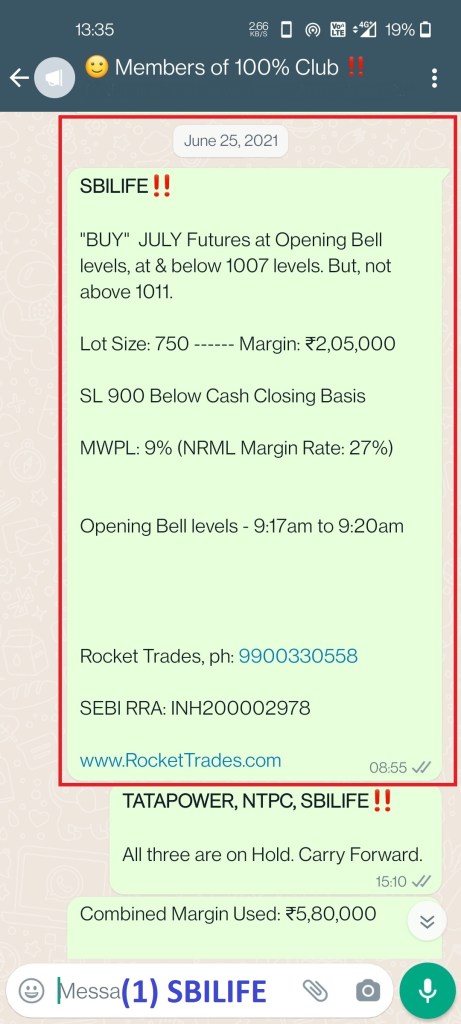

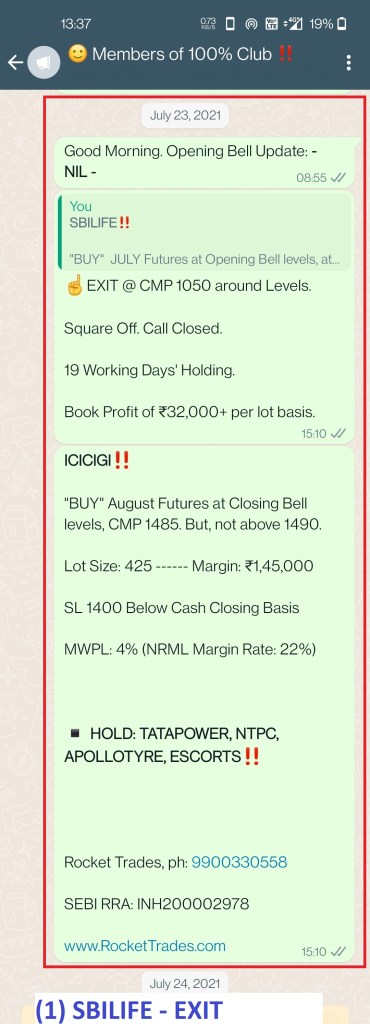

- SBILIFE: BUY Call

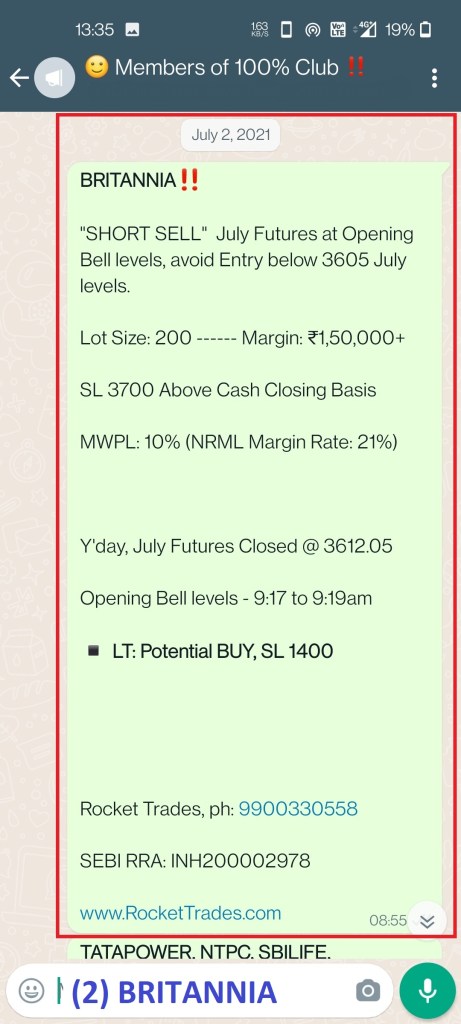

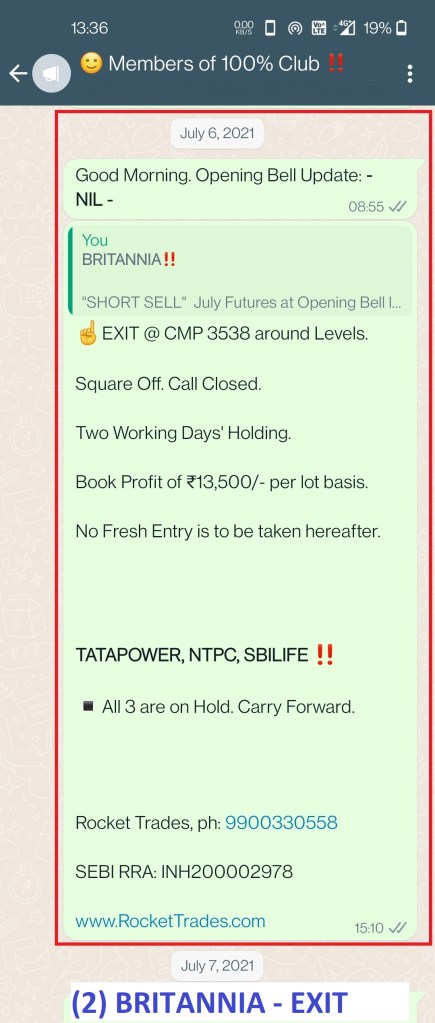

- BRITANNIA: Short Sell Call

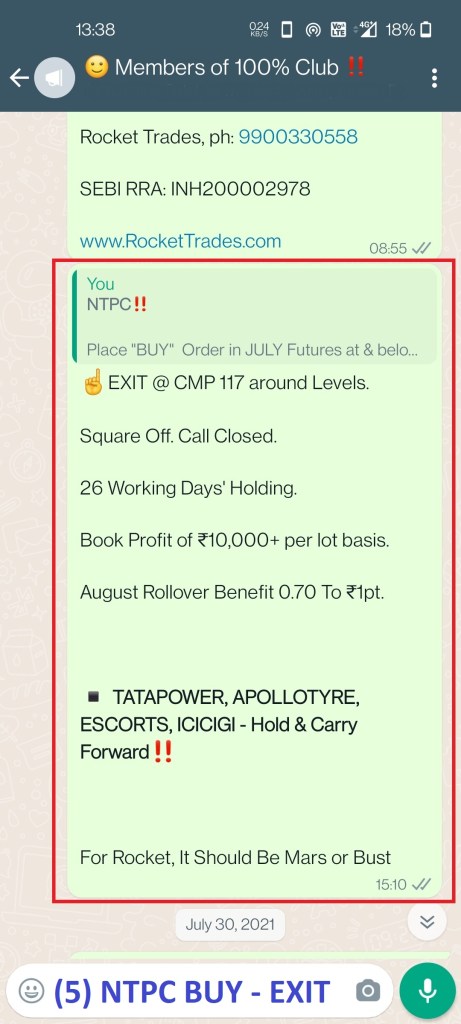

- NTPC: BUY Call

- APOLLOTYRE: Short Sell Call

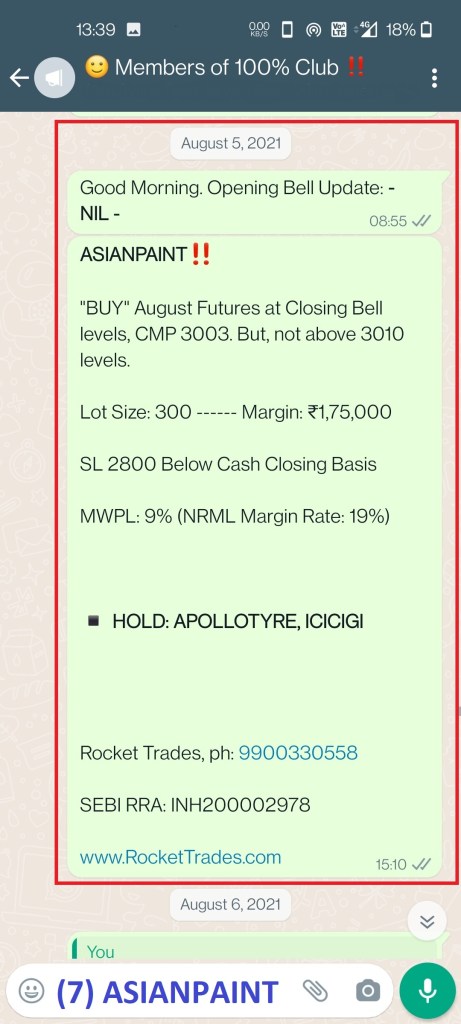

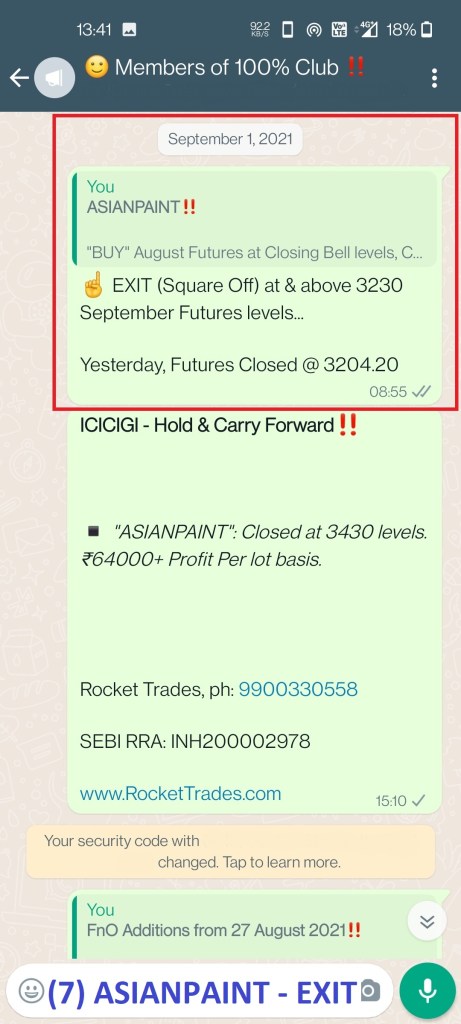

- ASIANPAINT: BUY Call

- Missed Profits 😢

- SBILIFE: Early Exit – Rotated Funds to ICICIGI @ 1050 – After that HIT 1200+.

- FEDERALBNK: Missed 50000+ Profit per lot basis by 15paisa – thin margin.

- MCDOWELL-N: Missed 2,00,000/- Profit per lot basis.

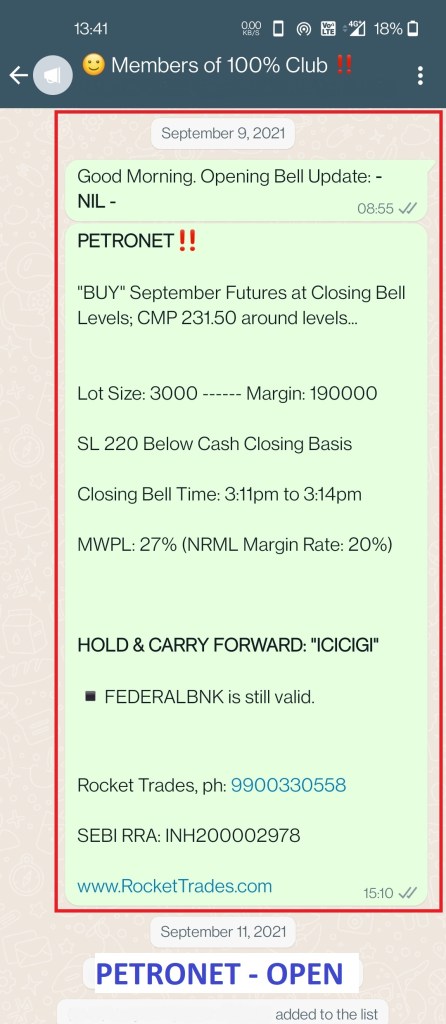

Carry Forward Positions to December Quarter are “ICICIGI, PETRONET, CHOLAFIN”

Positions Closed this Quarter which were carried forwarded: TATAPOWER

Upon counting all the Profits & Losses Booked during the Period: Net Profit ₹161500/-

Counted Per lot basis. Excluding Open Positions’ MTM, Brokerages, Government Taxes.

“ENTRY”

“EXIT”

“OPEN”

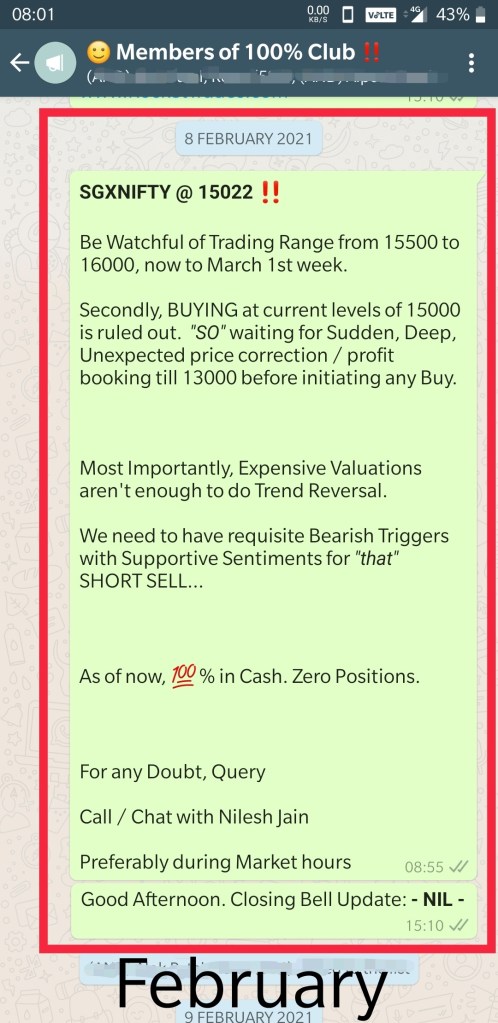

January February March 2021

1st Quarter of 2021

April May June 2021

2nd Quarter of 2021

Conclusion:

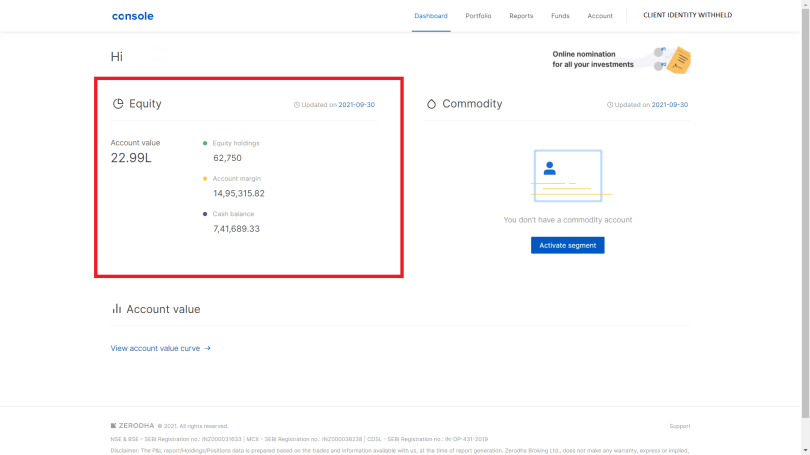

To a member of 💯% Club following performance has been achieved in the Nine months of 2021.

- First Quarter: ₹1,53,000/-

- Second Quarter: ₹1,63,000/-

- Third Quarter: ₹1,61,500/-

IRCTC: Though, comes in last Quarter but count in this Quarter itself. And with 120pts Loss. That is the Highest. Only one Member has exit around 4080 levels. Rest all exit in range of 4020 to 4040.

All this by using 6lac Capital – that is Client’s Core Capital.

All these on One Lot basis and after adjusting for all the losses.

80% Return on Investment in 9 months. We have three more months to go.

Now, 6lac + ₹4,77,000/- Booked Profit + Positive MTM of ICICIGI, PETRONET, CHOLAFIN.

Need more help?

☎ +91 9900330558, Bengaluru; Preferably during Market Hours (9am to 4:00pm).

You must be logged in to post a comment.