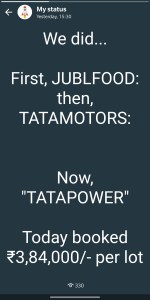

Neat, Clear and Genuine Profit without a doubt. 😊🙏

Our Biggest Profit with the Largest Holding Period, Till Date.

And, we outlined the details for motivation and to rise bar, quality, expectations…

ROI: 100% Return in Less than 100 Days

Original Investment was ₹3,73,000, Booked ₹3,84,000

“isko bolte hai dono haanthon se laddoo khana” !!

Once again, You shall think that we got lucky with TATAPOWER after TATAMOTORS.

No Problem, We accept that “YES” we, once again, proven to be Lucky even in FY 2021 – 2022, too.

This is a different thing that Pillars’ Strategy had found TATAPOWER at the most tedious Market Conditions.

And, that was preciously the reason why few of our Paid Members had ignore the TATAPOWER Entry.

Nothing wrong in Following Your Heart and Mind in Trading. That exactly we promote, too.

However, the Problem is why are we giving the “STOP-LOSS” (Cage) ⁉

Fortunately, TATAPOWER didn’t give Second Chance; Forget about Hitting Stop-loss.

As, Market didn’t want them to get into Dharmsankta (to get agree for what they didn’t want to) for the second time.

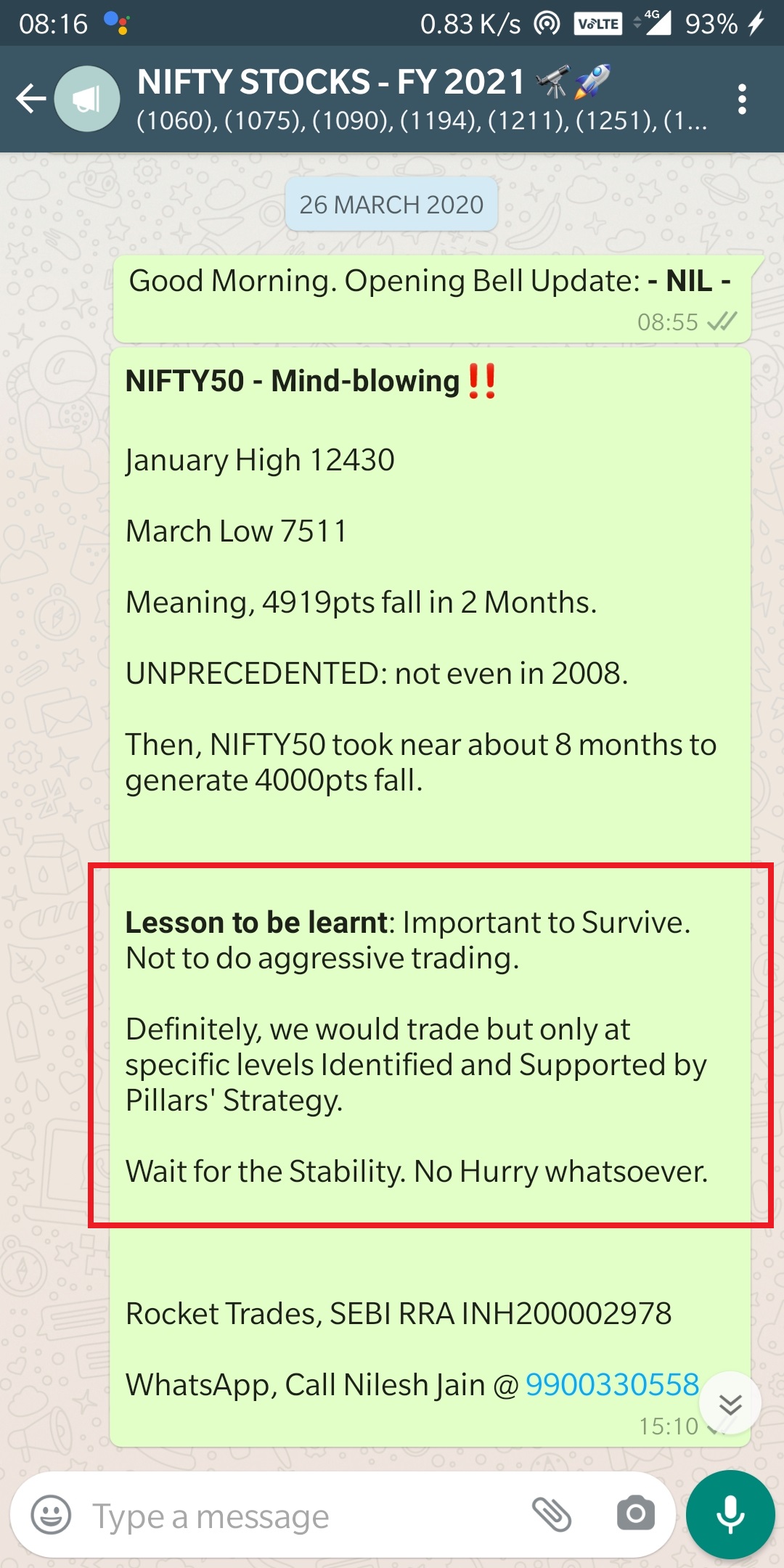

In the next segment below, we had summarized our best and worst of Performance in times of Covid-19 driven Market Volatility period.

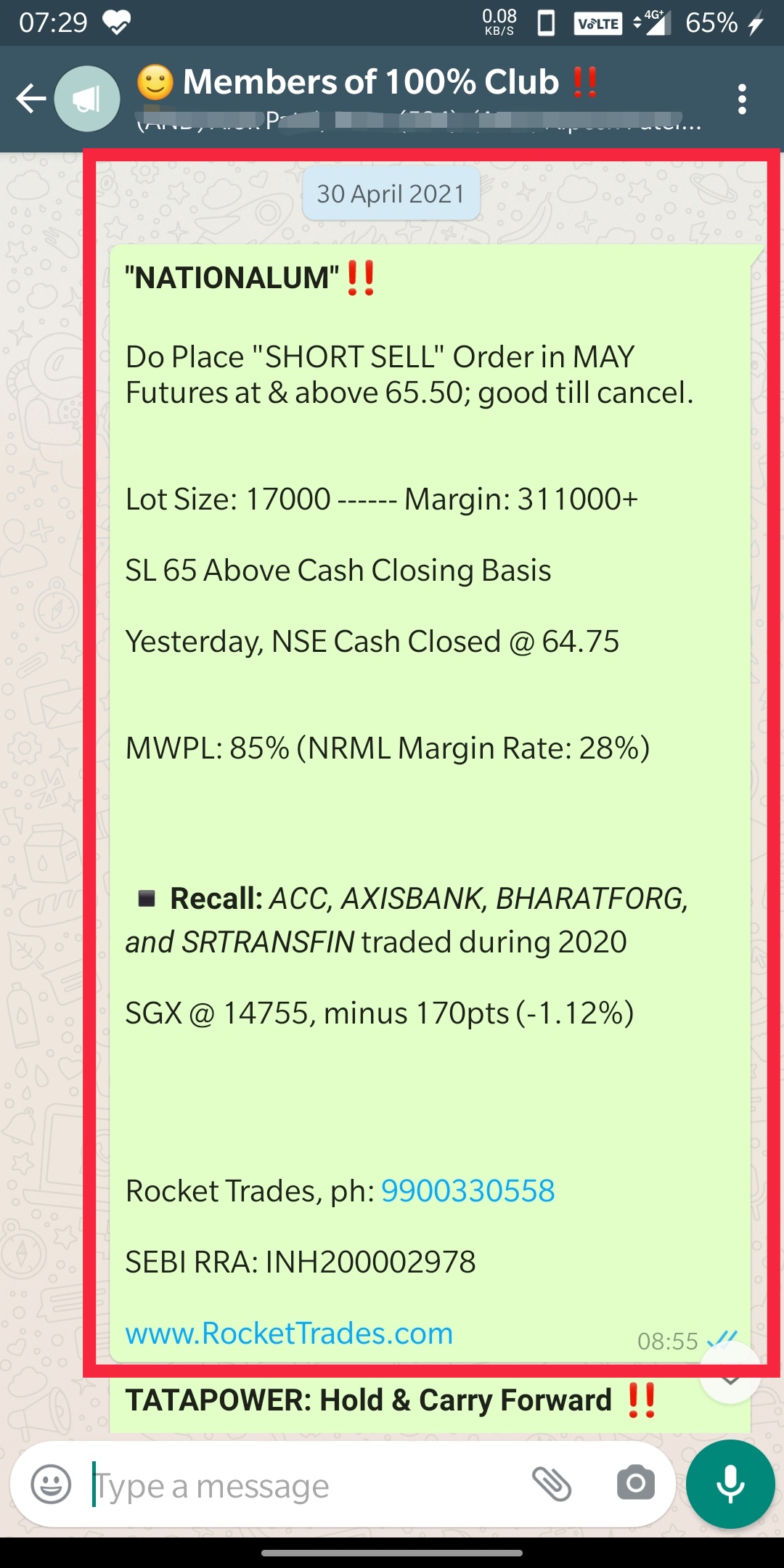

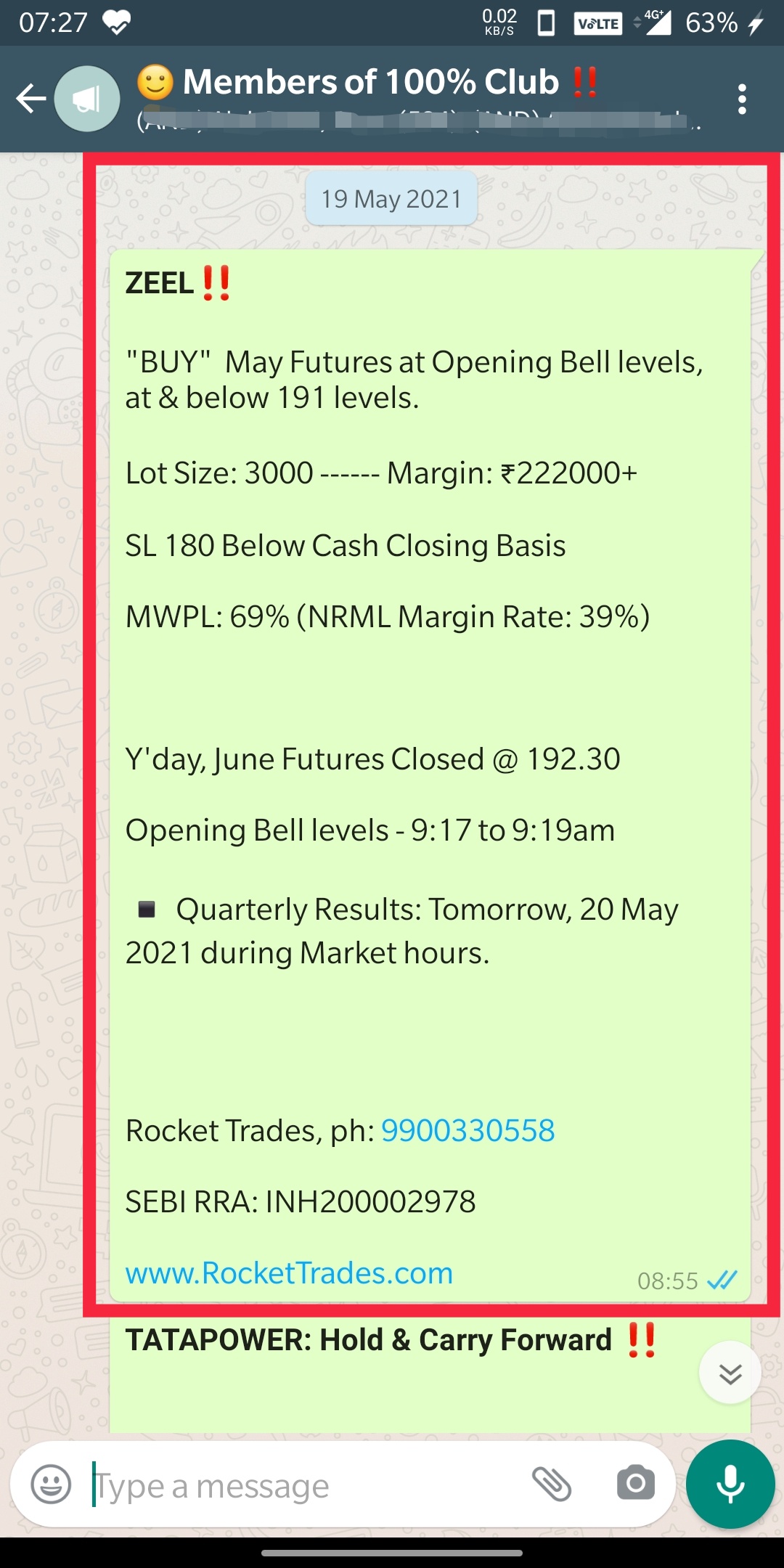

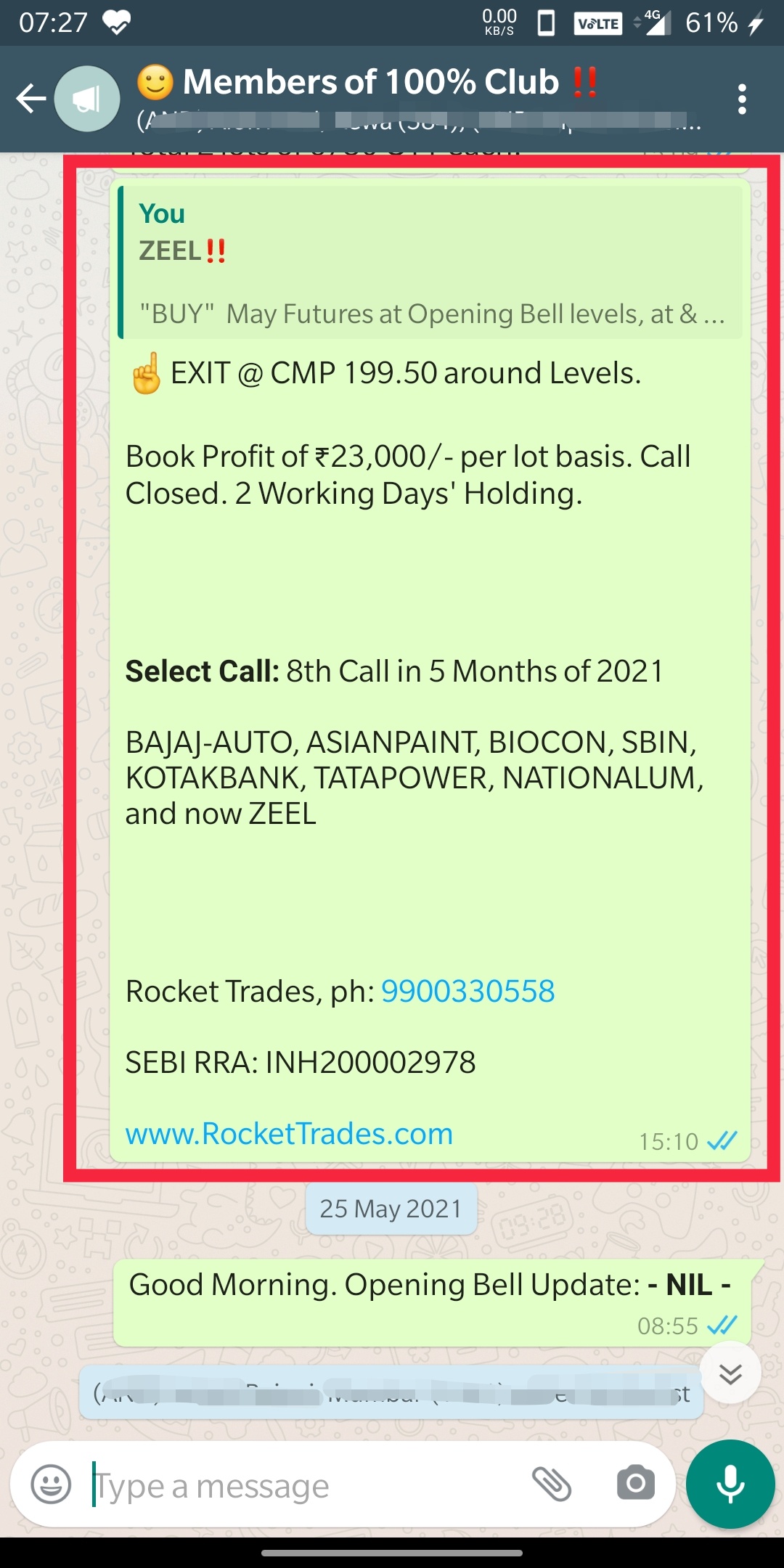

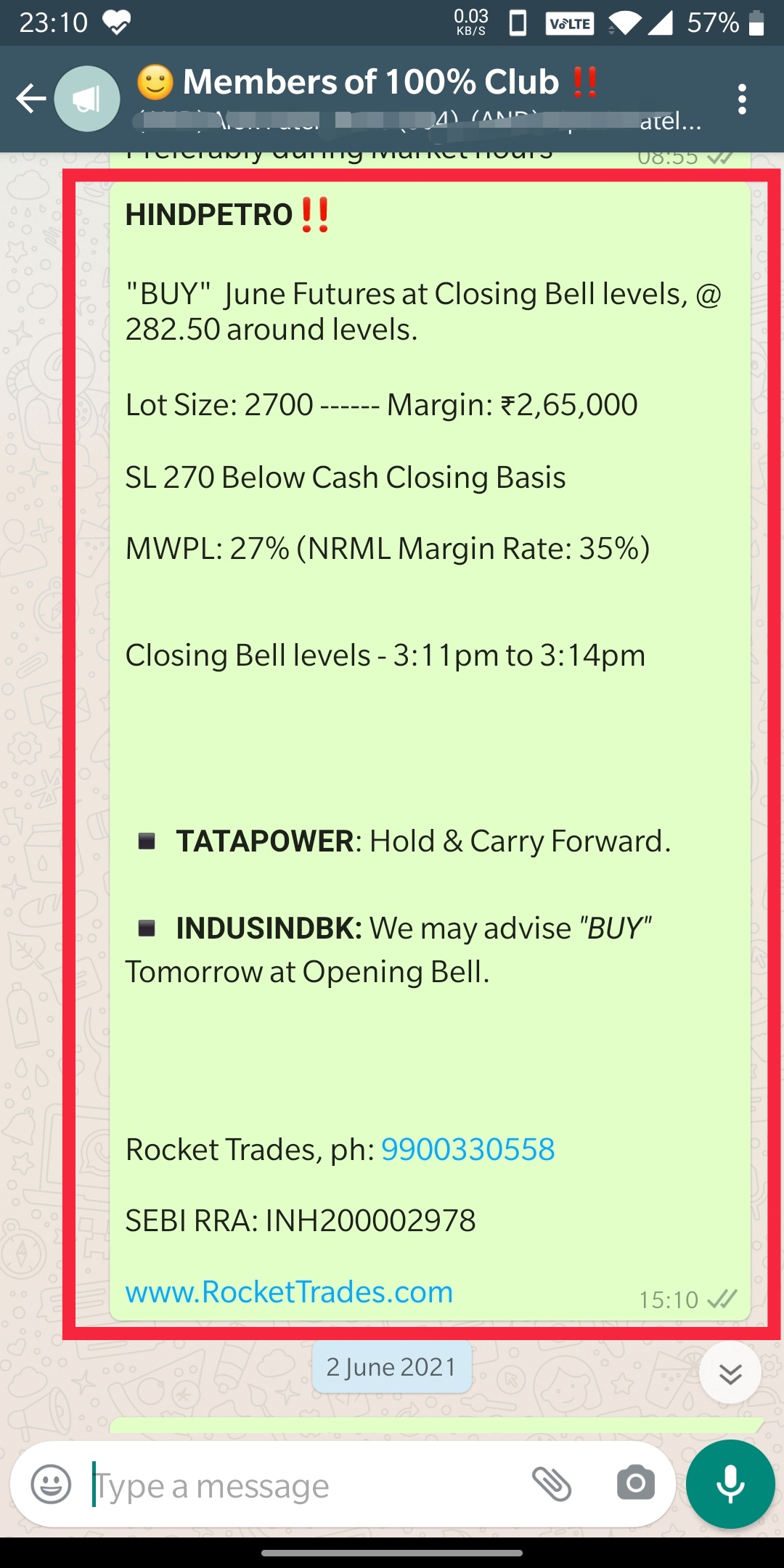

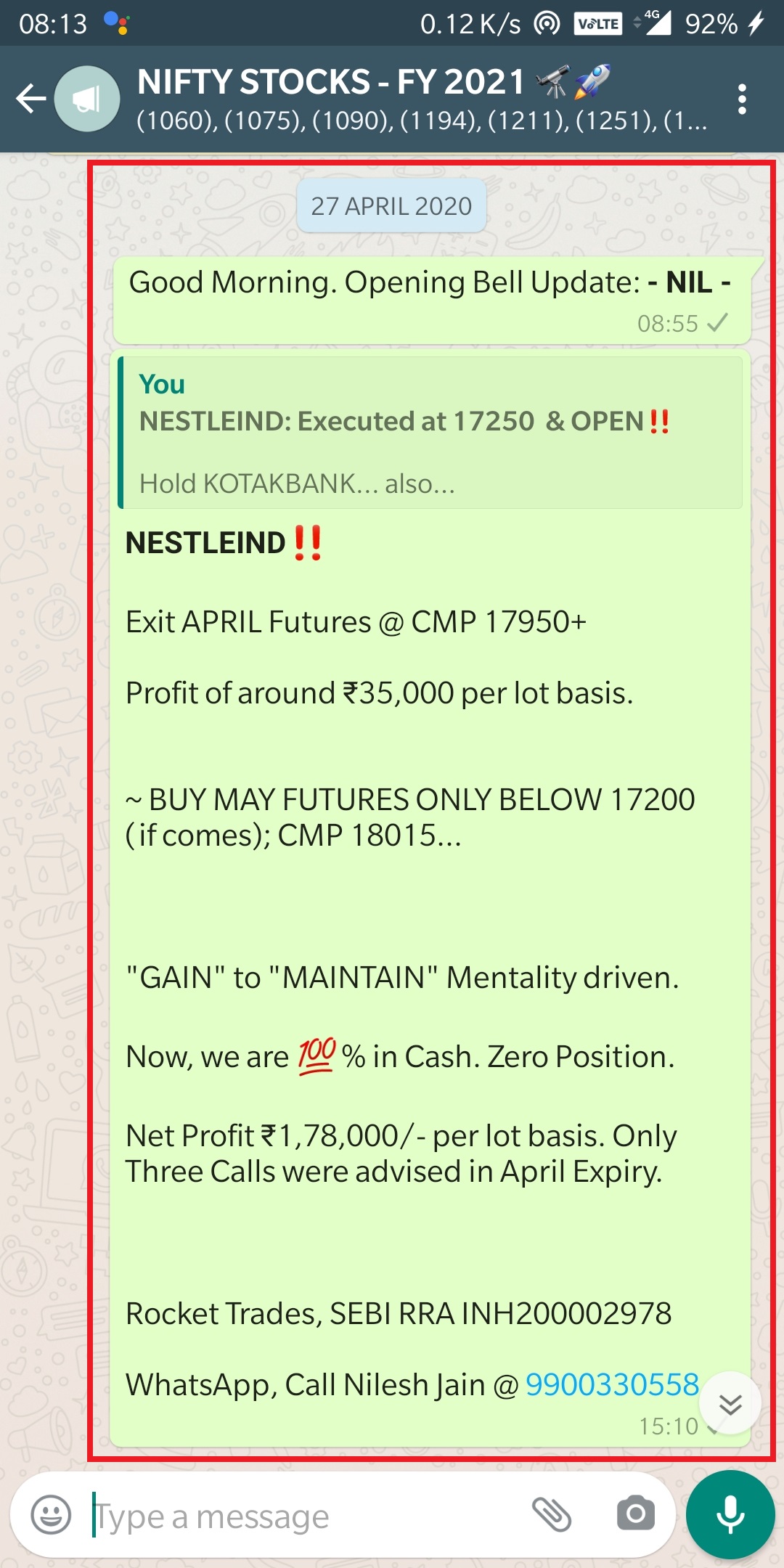

Pillars’ Strategy’s Trading Calls of FY 2020 – 2021

Lucky Calls

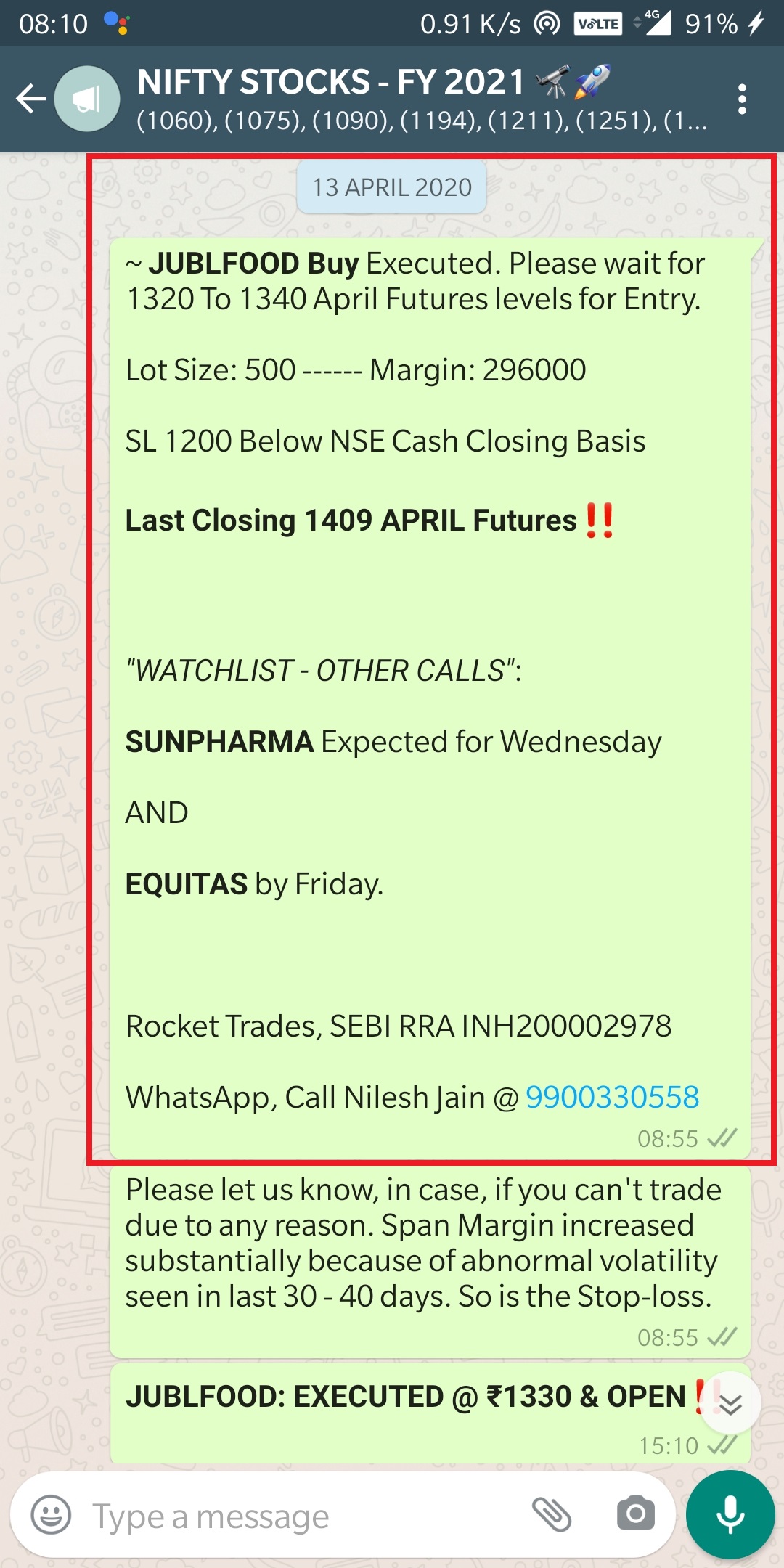

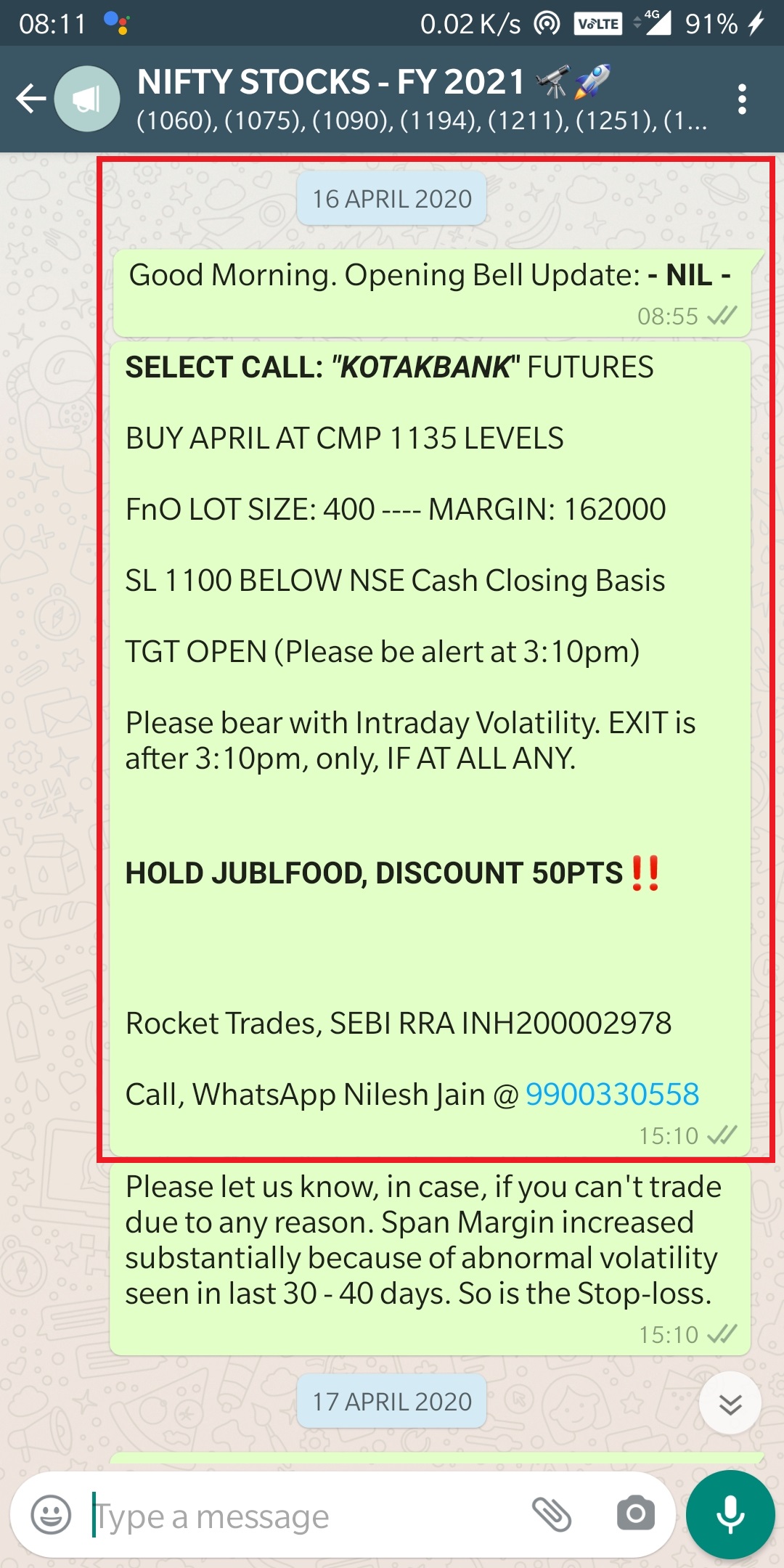

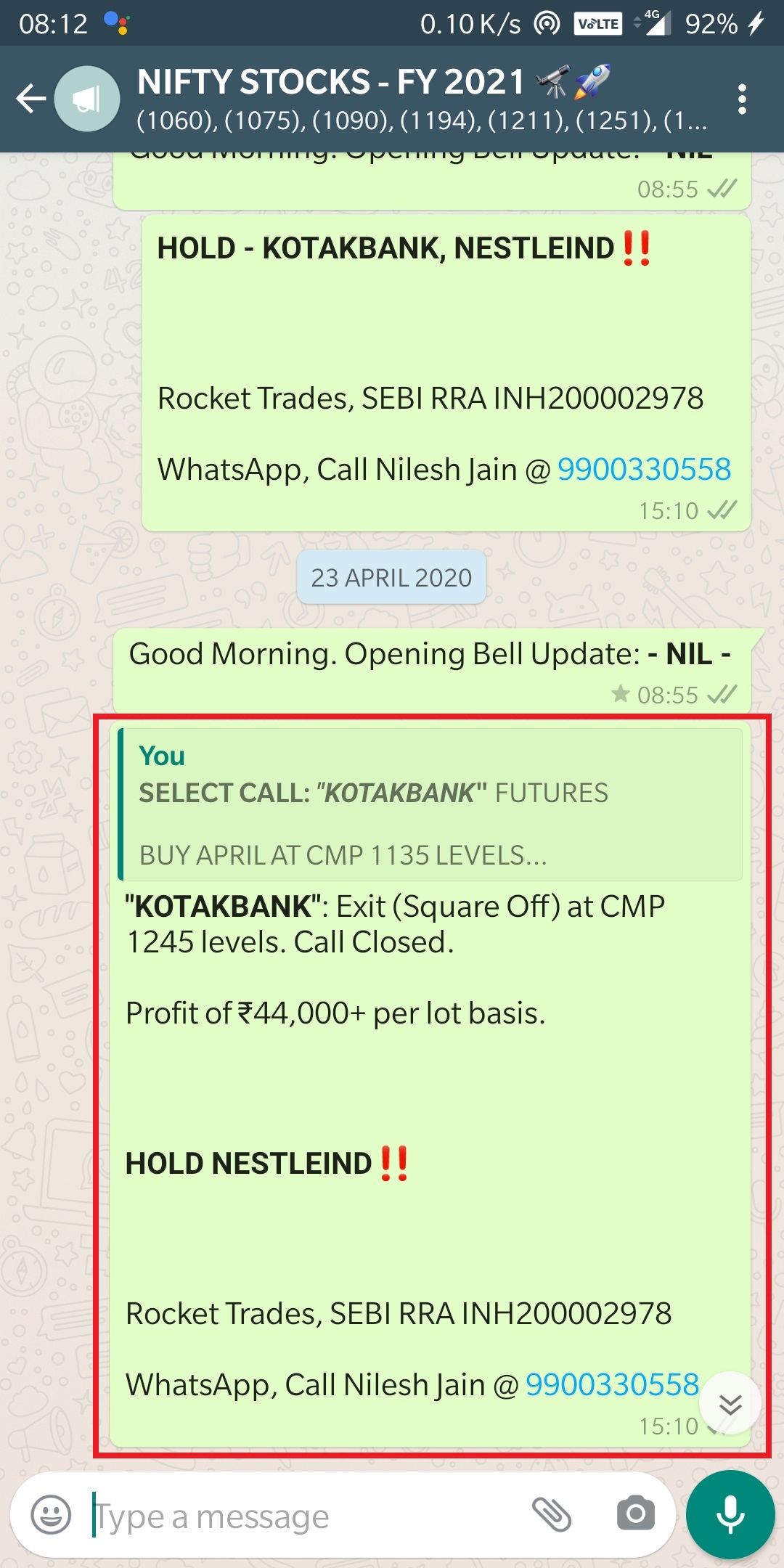

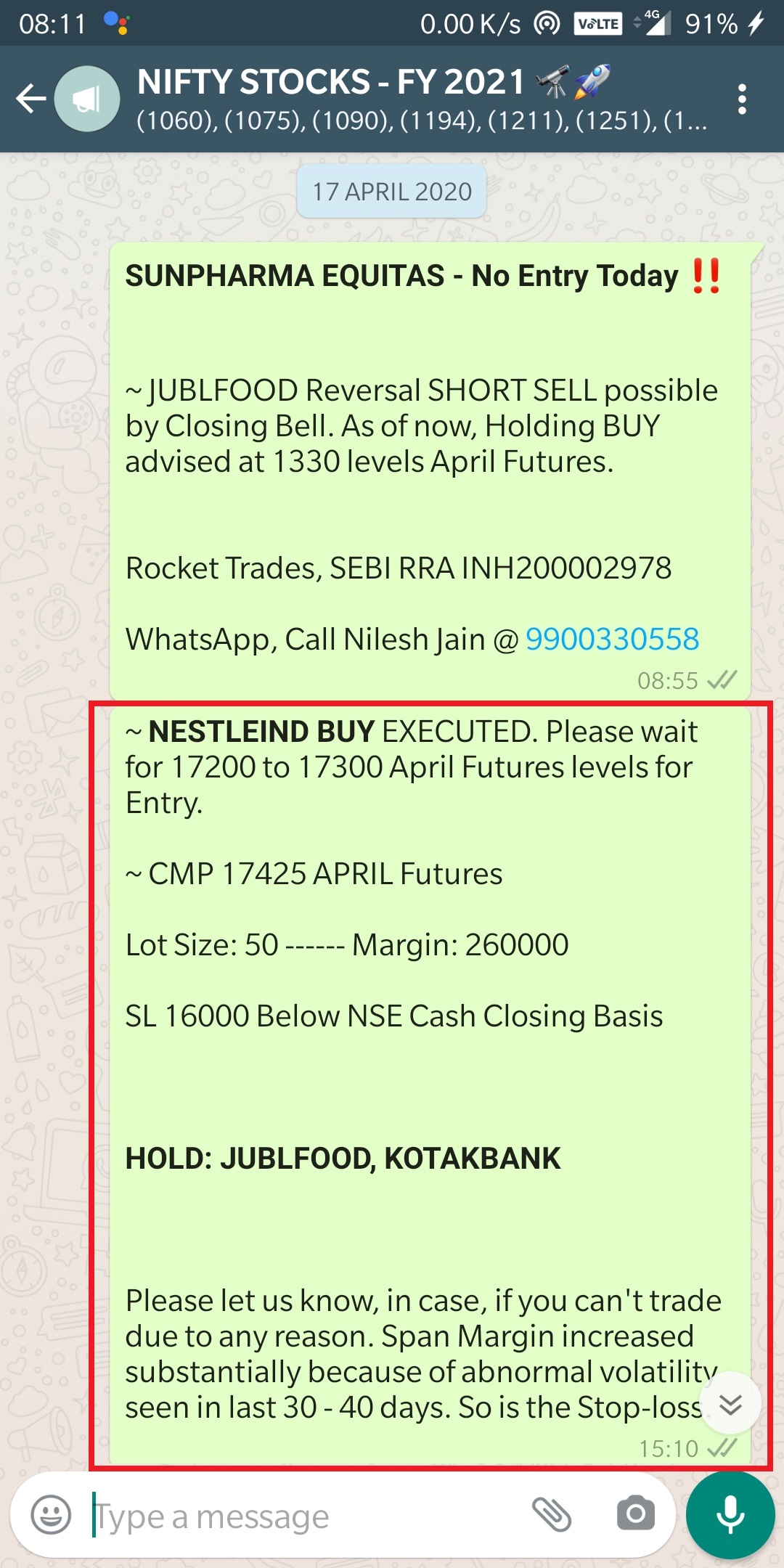

JUBLFOOD – April 2020

SUNTV – August 2020

TATAMOTORS – December 2020

BAJAJ-AUTO – January 2021

SBIN – March 2021

Unlucky Calls

HAVELLS – October 2020

TATAPOWER: Few Clarifications.

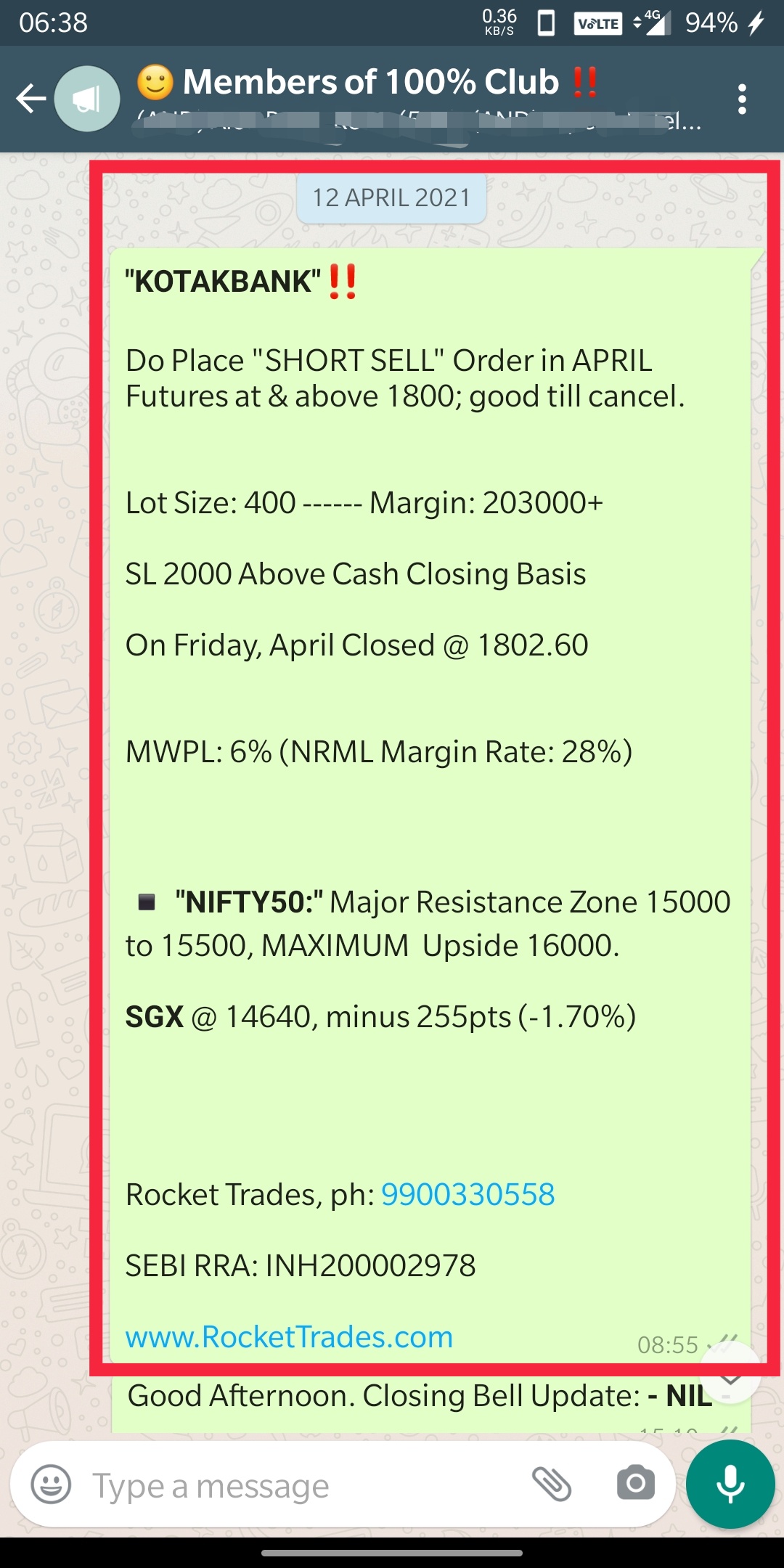

What was the Holding Period for TATAPOWER ?

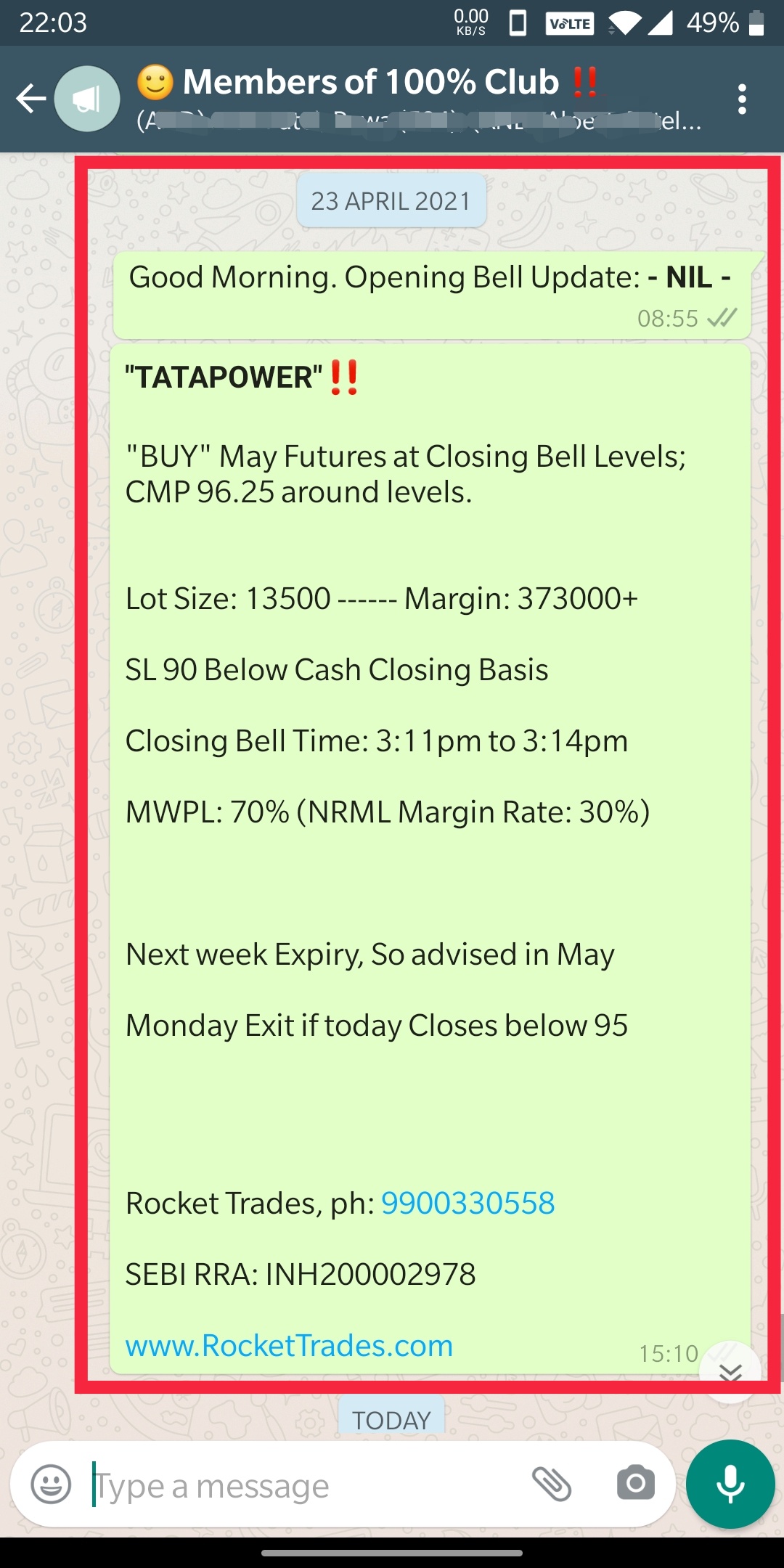

- Near about 97 Calendar Days, from 23 April 2021 to 30 July 2021

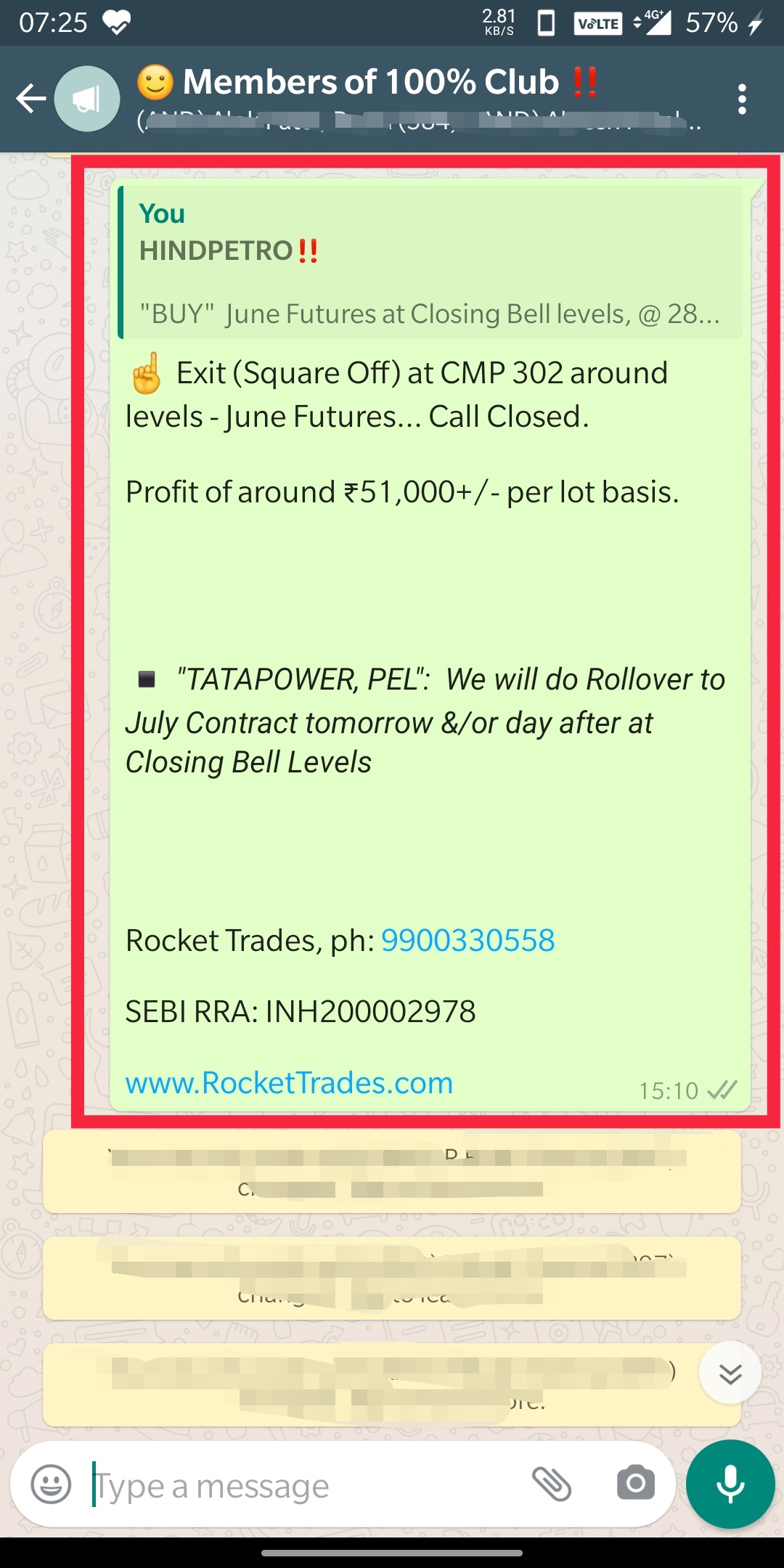

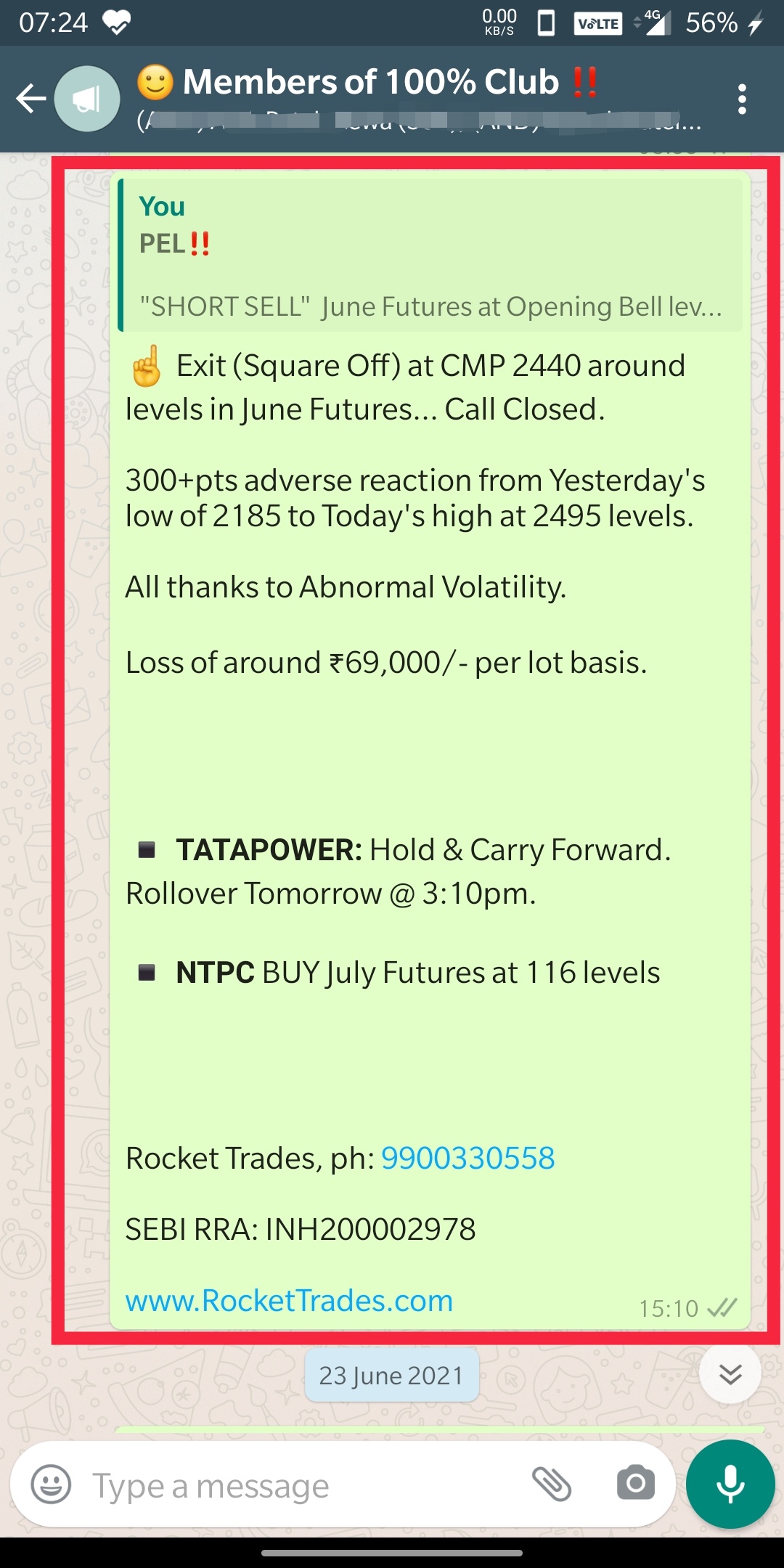

- Did 3 Rollovers, Original Entry was in May. Then Rollover To June, after that July and now did to August Futures.

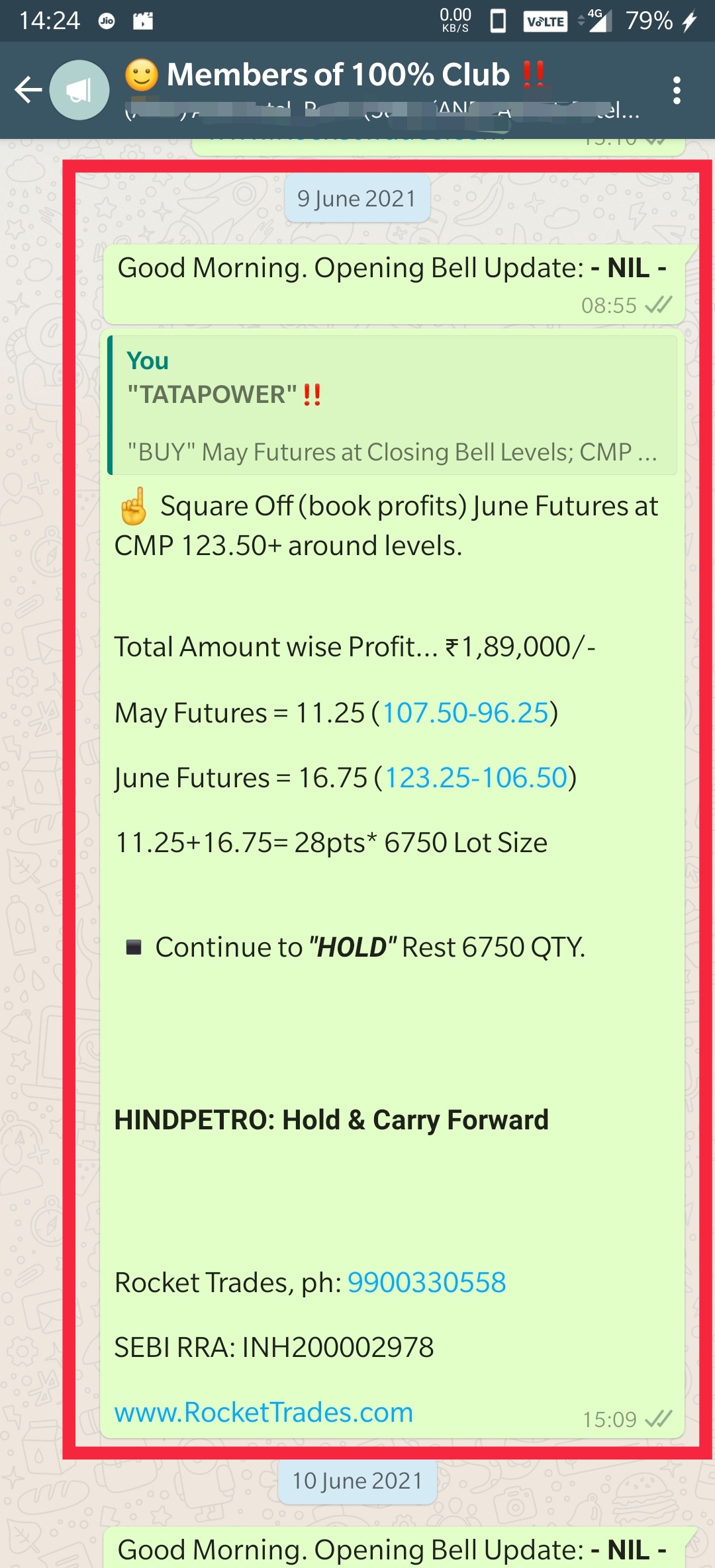

- Though we booked part profit of ₹1,89,000/- in June 2021 created by Split of Lot’s Size from Originally 13500 to 6750 at present.

Why was not Booked at Upper Circuit around 132 levels?

Because, We strictly follow Pillars’ Strategy Rules. If Random Exit was all that good then why not Exit at 100 itself. Why waiting till 132 odd levels?

Most Importantly. We either Exit at Closing Bell or at Opening Bells levels. And 132 level came & gone, all in Intraday, Market did not sustain.How & Why took so much pain in TATAPOWER ?

Booking Profit is very Easy for any one including us.

But, we also need the Outperformers to generate required return. Therefore, we prefer to hold given all the Panic, News, Events generated Market Volatility until it is absolute necessary to Exit. During these 97 Days of our Holding, we had seen Quarterly Results, RBI & FED Meetings, Governments Announcements & Media News related to Power Sector, Global Market Ups & Downs, almost everything.Screen Shot of WhatsApp Status of 9900330558

Next Target is to do ₹4,00,000/- Profit from a Single Script. Abnormal Volatility will help us.

Improve 1000 Little Things by 1%

You must be logged in to post a comment.